Sold 1 Put on WBA Stock – 27.96% potential income return in 206 days

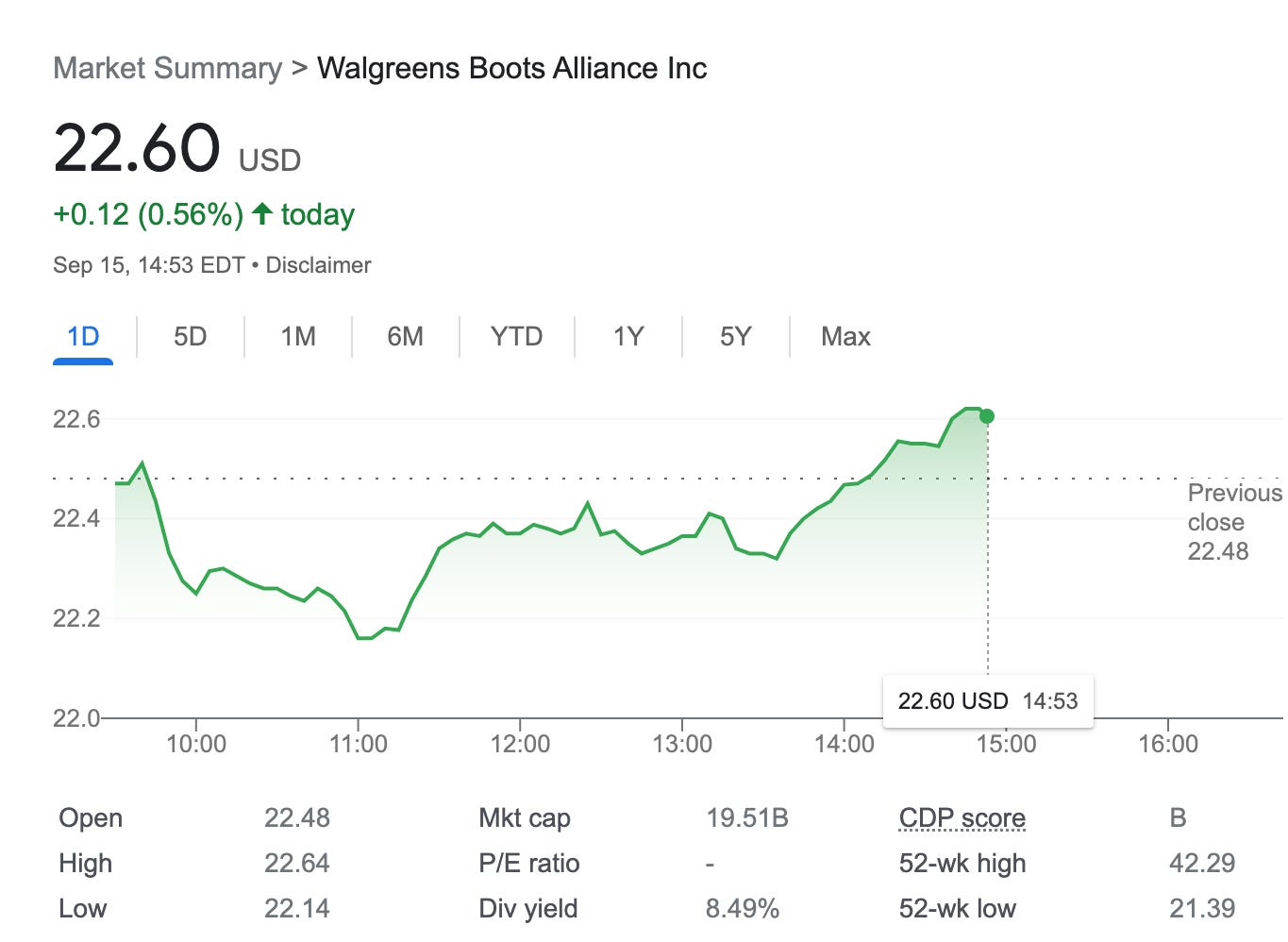

On September 15th, 2023, I sold 1 deep-in-the-money put option on Walgreens Boots Alliance Inc stock (NASDAQ:WBA) with a strike price of $25 and expiry on January 19, 2024. For this trade setup, I was rewarded with $354.19 (after commissions).

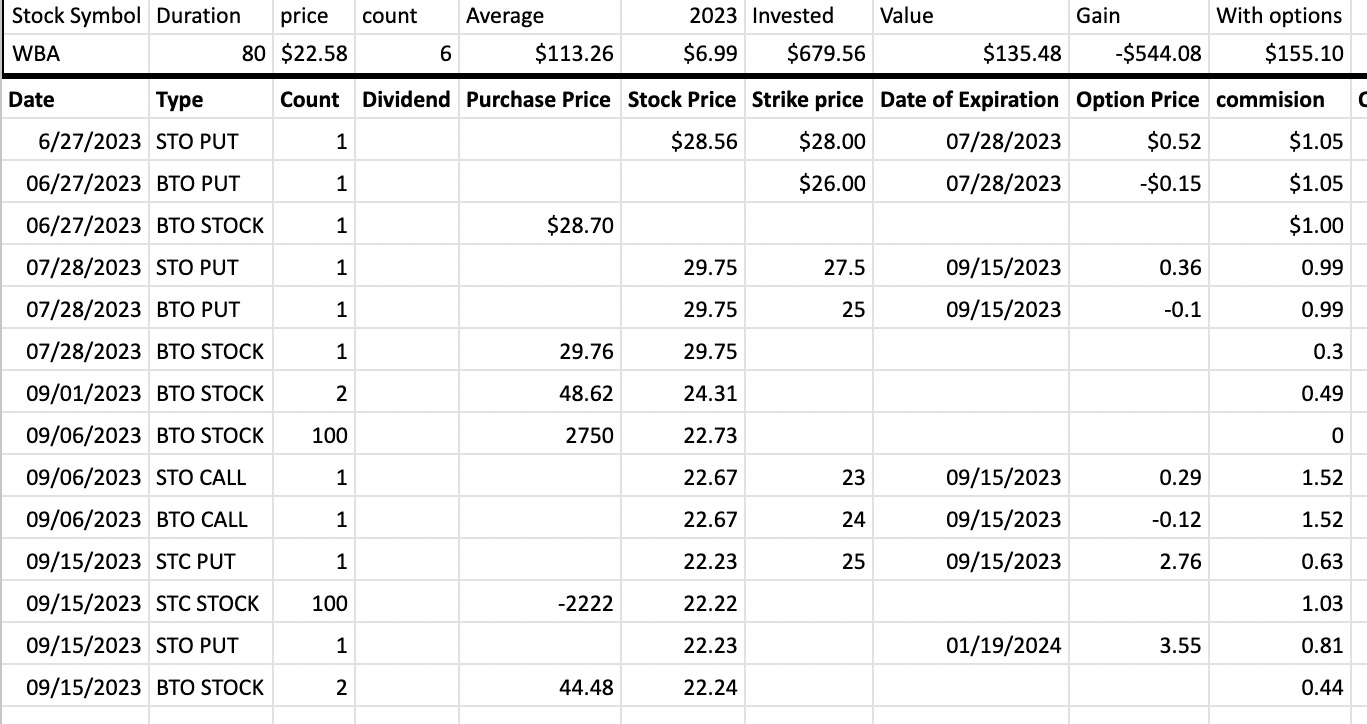

This trade is part of a larger trade, which I originally started back in June 2023 as a credit spread, and got assigned last week at 27.5 while still holding a long put with 25 strike price.

I came up with a plan to close the long put, sell the stock away, and open a new put option, maybe not be the smartest idea from the tax accountancy point of view, but I prefer holding put options in my portfolio rather than stock itself. At least at this moment.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

After selling 25 long put with today’s expiry, I managed to keep this trade under control (at least in the foreseen future), by lowering my break-even price significantly

Here is the trade setup:

SLD 1 WBA SEP 15 '23 25 Put Option 2.76 USD

SLD 100 WBA Stock 22.22USD

Here I sold the long 25 put for $276, and also I sold 100 shares away at $2,222.

Since opening this trade back in June/July 2023 I have already collected in premiums $699 or $6.99 per share

What happens next?

On the expiry date, January 19, 2024, WBA is trading above $25 per share - options expire worthlessly and I keep premium - if WBA trades under $25 on the expiry date, I risk getting assigned 100 shares and paying for them $2,500.

Current break-even price: 27.5-0.24-0.14-2.76-3.54 = $20.82

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 14 trades since June 27, 2023

Options premium: $699

Stock gains: -$544.08