Assigned 100 shares with WBA (still holding long put as protection)

On September 7, 2023, I got assigned 100 shares with WBA stock at the price of $27.5 per share. Luckily this was a part of the credit spread and I’m still holding a long 25 put with the September 15 expiry.

WBA stock has been troubled lately, and just keeps sinking week after week.. Are we at the bottom? Nobody knows, it could keep failing to 0… been there and seen that.

Originally this trade was established at the end of July 2023 as a credit spread (27.5/25) for a credit ($0.24). And my break-even price was $27.26 (27.5-0.24)

Now with WBA trading at 22.5 I’m losing $4.76 per share. But As I still have the long put, it actually offset the loss by $2.5. Technically my loss is $2.26 or $226.

As there is still one week till the long put expiry on September 15, I decided to wait for another week, in case the stock keeps failing, so I can capture a better break-even price. But while waiting I sold the call bear spread with next Friday’s expiry:

Here is the trade setup:

BOT 100 WBA Stock 27.5 USD (assigned)

SLD 1 WBA SEP 15 '23 23 Put Option 0.27 USD

BOT 1 WBA SEP 15 '23 24 Call Option 0.14 USD

Here I bought 100 shares for paying $2,750 and sold 1 dollar wide call bear spread for $0.14 premium

What happens next?

On the expiry date, September 15, 2023, WBA is trading under $23 per share - options expire worthlessly and I keep premium - if WBA trades above $23 on the expiry date, my 100 shares risk getting called away and I will get $2,300.

In case the price goes over $24 next week, I will make some gains from the long call.

In case the price stays under $23, I will close the long put and lower the break-even price, before taking a decision to keep the shares and start selling covered calls or selling shares and selling a new put option with a lower strike price (thus decreasing my break-even)

Current break-even price: $27.5-0.24-0.14-long put = $27.12 - long put.

At the time of writing the value on the long put was $2.4. Technically the break-even price is $24.72

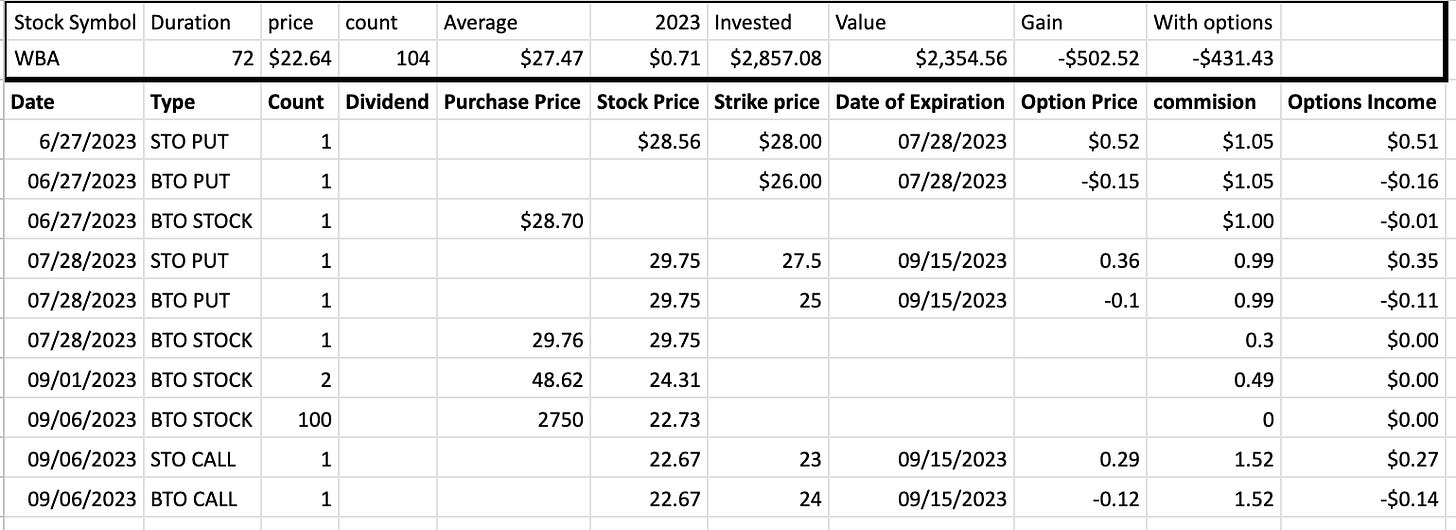

In total: 10 trades since June 27, 2023

Options premium: $71

Stock gains: -$502