Week 43: Boring but Profitable — BMY Credit Spread Brings in $65 Options Premium

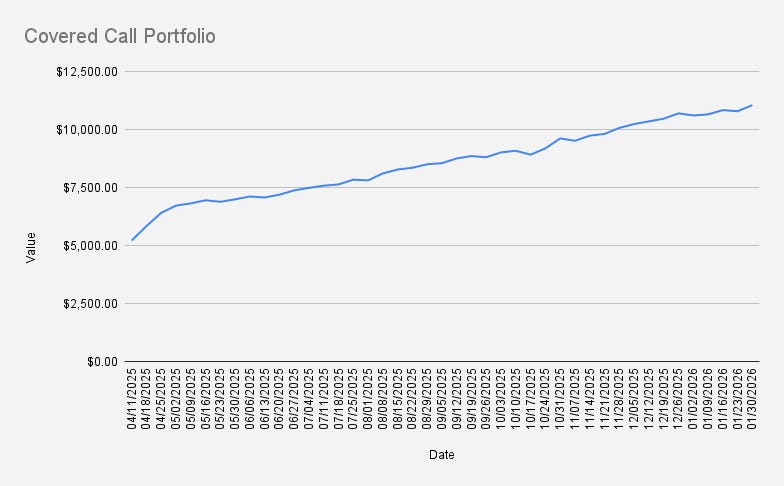

As of January 30, 2026, our covered-call stock portfolio has once again increased by +2.43% and closed at $11,050. For the first time, we’ve cracked the $11K milestone. Awesome.

Interestingly, we kept activity minimal this week the only new trades were BMY credit spreads opened today. Despite that, the NVDA-centered portfolio is clearly outperforming the…