Week 37 / NVDA & BMY: Portfolio Up +1.11% as We Head from Tbilisi to India

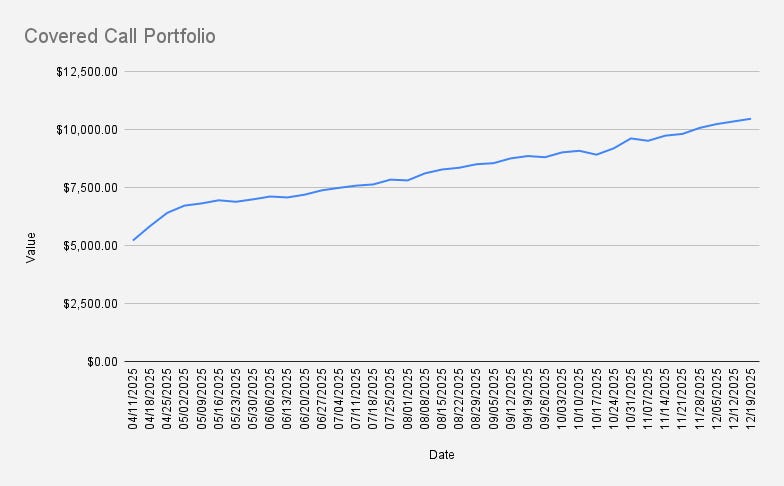

As of December 19, 2025, our covered-call stock portfolio has grown by an additional 1.11% and reached $10,465. It’s genuinely exciting to be above $10K for the fourth week in a row. I was expecting to fall under $10K this week as volatility kicked in, but the result is better than expected.

Year-to-date, we’re up 33.73%, outperforming the S&P 500 by a w…