Week 36 / Defensive Roll on SHELL, New NVDA Weekly Spread

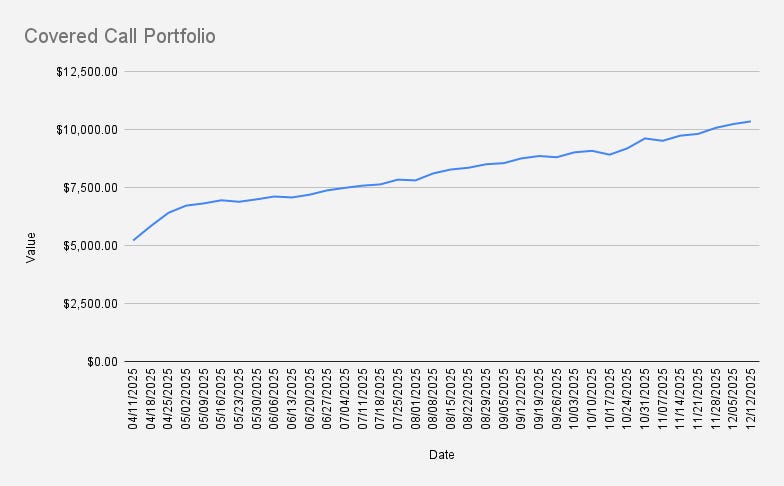

As of December 12, 2025, our covered-call stock portfolio has grown by an additional 1.12% and reached $10,350. It’s genuinely exciting to be above $10K for the third week in a row.

Still, I’ve been in the stock market too long to rule out a possible pullback in the upcoming weeks.

Year-to-date, we’re up 27.64%, outperforming the S&P 500 by a wide margin …