Week 33 / How We Earned $166 in Options Premium This Week with NVDA and BMY Credit Spreads

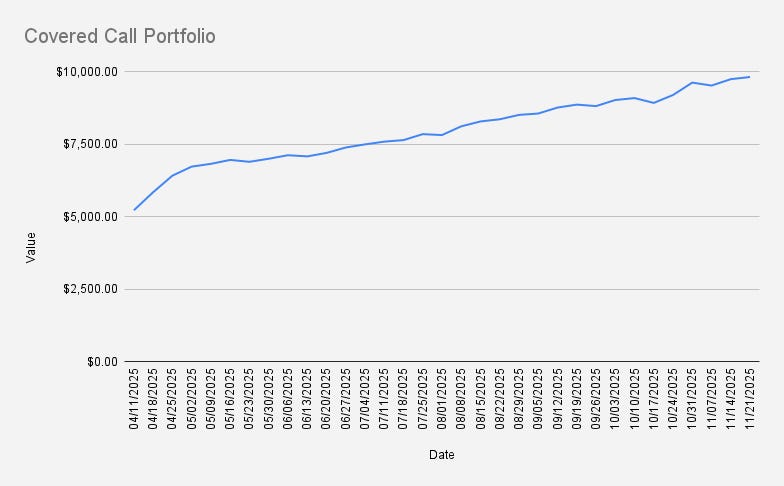

As of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels so close. With disciplined risk management, we should be able to hit it by year-end - a solid springboard for 2026.

That said, our stock portfolio is performing s…