Week 30 / NVDA, BMY and SHELL Options: $161 Premium, +4.65% Return

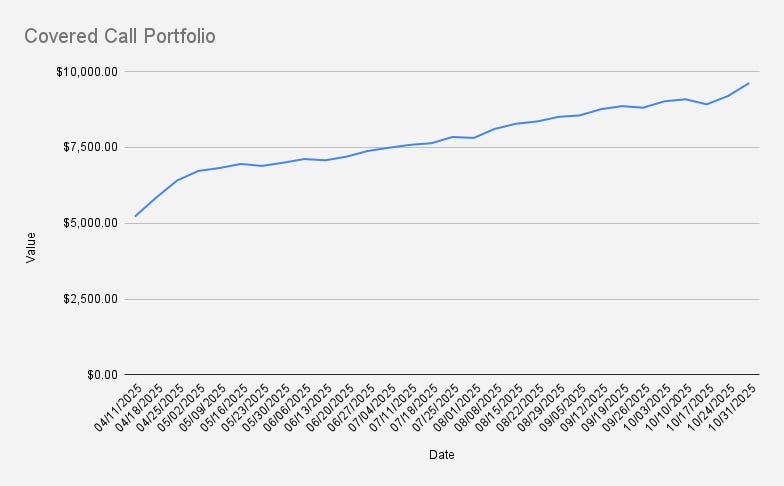

As of October 31, 2025, our covered call stock portfolio has grown to $9,617, what is a significant increase of +4.65% (+$426) if compared to the previous week.

The strong performance in our portfolio was driven by a rebound in BMY’s share price and NVDA’s historic breakout above $200, making it the first company ever to surpass a $5 trillion market cap…