Week 26 / NVDA Covered Call Roll Adds ~$300 in Six Months (Update)

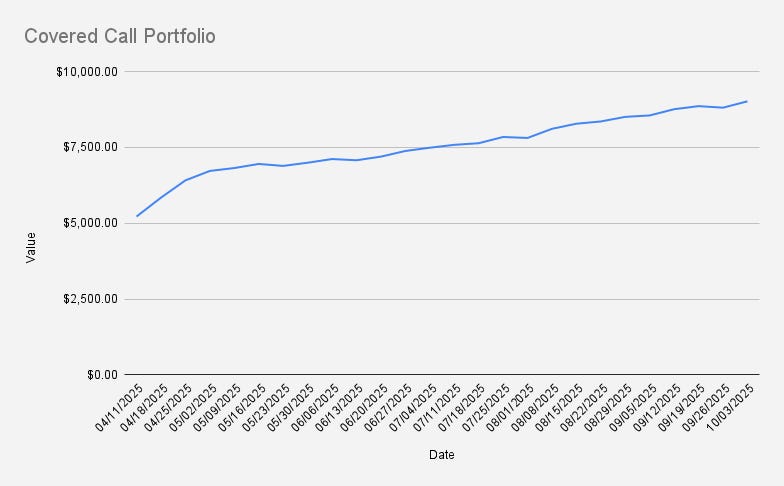

As of October 3, 2025, our covered call stock portfolio has reached $9,017, what is a decent increase of +2.38% (+$209) if compared to the previous week. While YTD, the portfolio is already up by +15.44%. Technically, we’re slightly outperforming the S&P 500 this year. Practically though, wouldn’t it be simpler to just buy and hold the SPY ETF?

On the ot…