Week 25 / NVDA Covered Call, BMY Spread Risk, UBER Spread, MCD Added

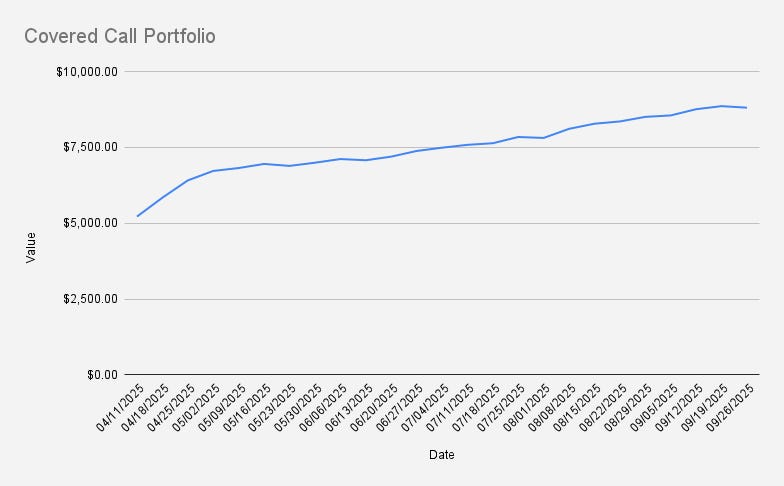

As of September 26, 2025, our covered call stock portfolio has reached $8,807, slightly decreasing by -0.58% (-$50). Year-to-date, the portfolio is up +12.75%. Technically, last week’s drop might be attributed to USD/EUR exchange rate fluctuations, as our base currency is set to EUR and we are therefore affected by forex movements.

This week, we collecte…