Week 24 / BMY & NVDA Rolls Pay Off; Portfolio +1.15% This Week

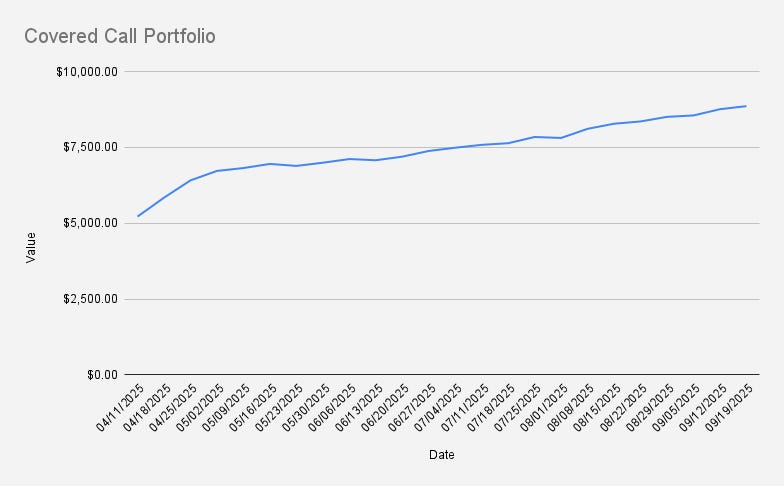

As of September 19, 2025, our covered call stock portfolio has reached $8,858, marking another weekly gain of +1.15% (+$105). Year-to-date, the portfolio is up +12.39%. Technically, we’re slightly underperforming the S&P 500 (+13.31%), but I’m very satisfied with the progress - the $10K milestone with every week comes closer.

Surprisingly, for most of th…