Week 22 / Options Income Report: 1.25% Weekly ROI From NVDA & BMY Trades

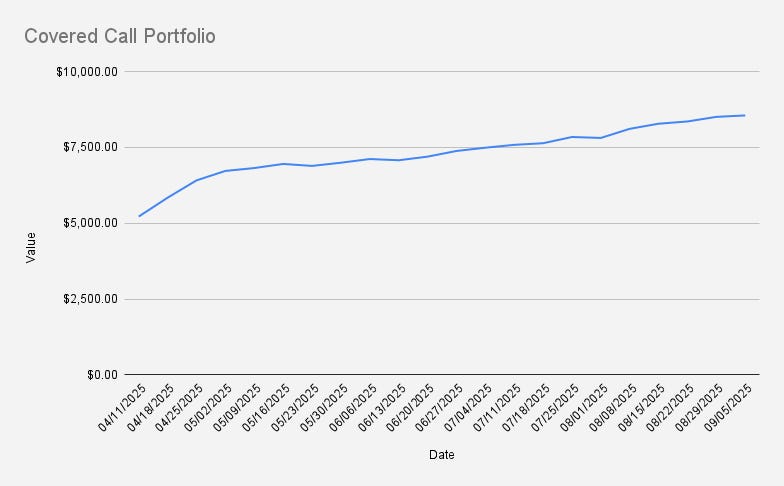

As of September 5, 2025 ,our covered call stock portfolio stood at $8,552, what is another weekly increase of +0.56% (+$47). While Year-to-date, our portfolio is +8.41%. Awesome!

For the record, our portfolio is influenced by EUR/USD exchange rates. If the euro hadn’t been trading at 1.18 against the dollar, our portfolio would actually be down a few dol…