Week 14 / WFC Credit Spread & NVDA Covered Call Strategy – Weekly Options Income Hits $83

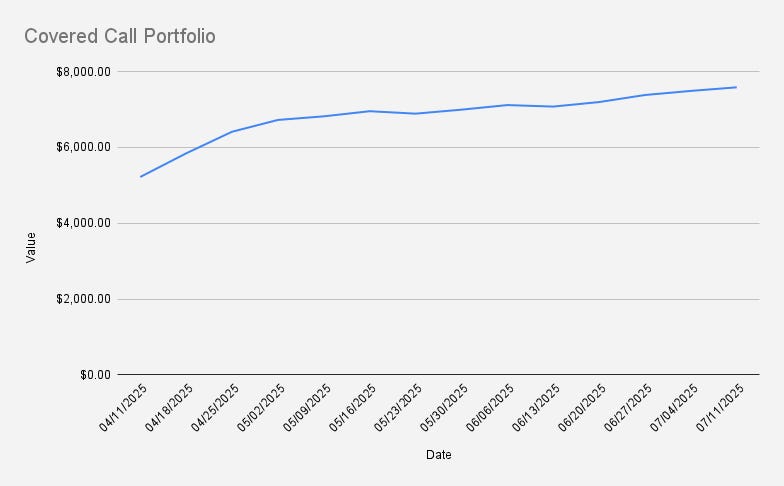

As of July 11, 2025, our covered call stock portfolio stood at $7,582, another +1.26% week-over-week increase (+$94). Year-to-date, we are still down -2.94%.

Unlike previous weeks, this time I initiated a new credit spread on WFC (Wells Fargo), using the premium received to purchase shares of WFC itself. If not assigned, I’m considering selling additiona…