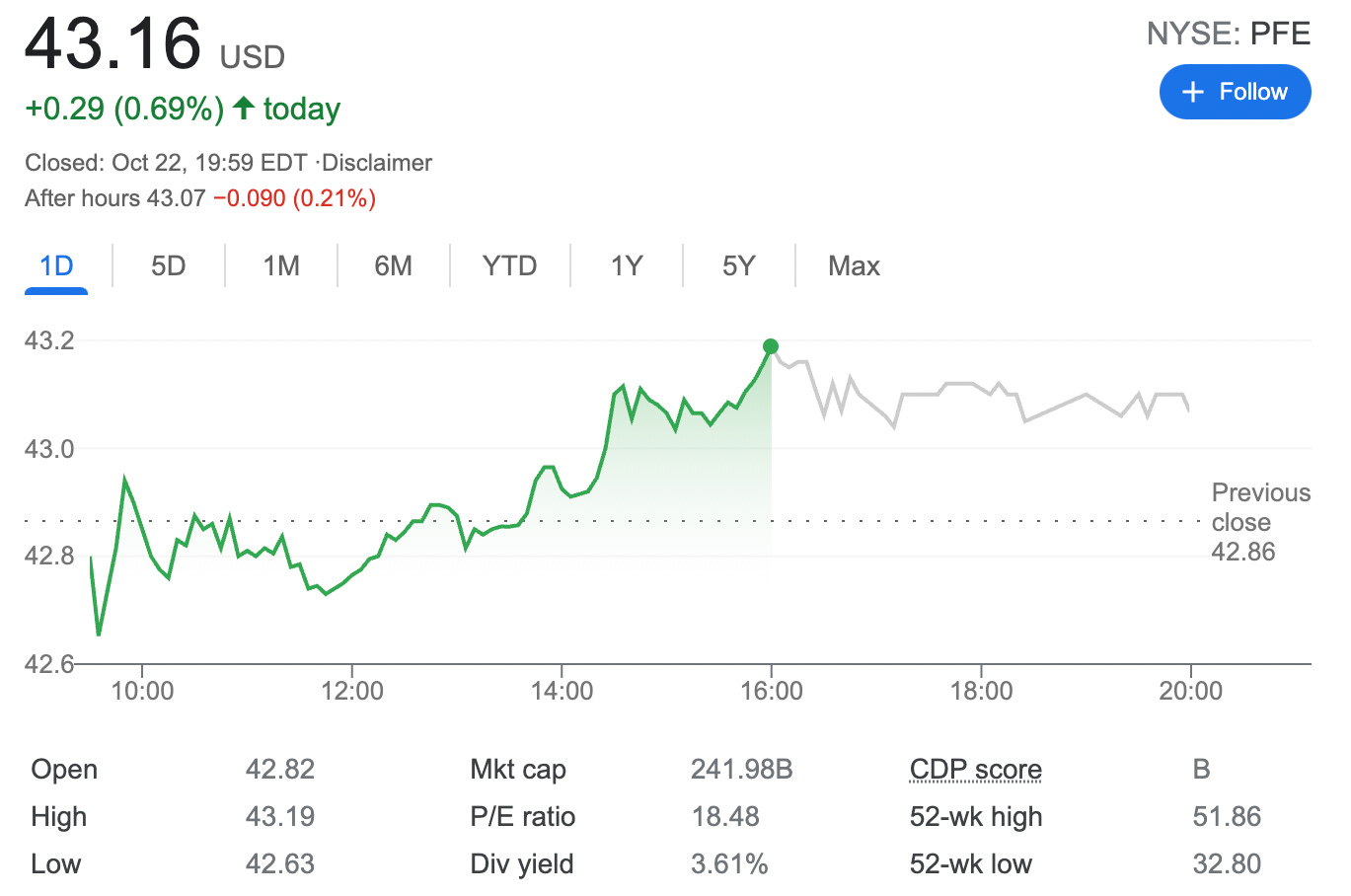

Trade Alert: Rolled-forward and up PFE Covered Call - 0.44% potential income in 11 days

On October 22, 2021, I rolled up and forward 1 covered call with PFE

Originally I entered this trade a week ago, see: Sold 1 Call Option on PFE – 0.08% potential income return in 4 days

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German immigrants, Charles Pfizer and his cousin Charles F. Erhart

here is the trade setup:

BOT 1 PFE OCT 22 '21 43 Call Option 0.16 USD

SLD 1 PFE OCT 29 '21 43.5 Call Option 0.39 USD

Here I bought back the $43 call option with today’s expiry paying $16 and sold a new call option with a higher strike price but with an expiry next Friday. For this trade, I got $39 (before commissions).

What happens next?

On the expiry date, October 29, 2021, PFE is trading under $43.5 per share - options expire worthlessly and I keep premium - if PFE trades above $43.5 I'm troubled as I need to deliver shares I don’t have, to avoid such scenario I will roll up strike prices

Break-even price: $43.5+$0.22= $43.72