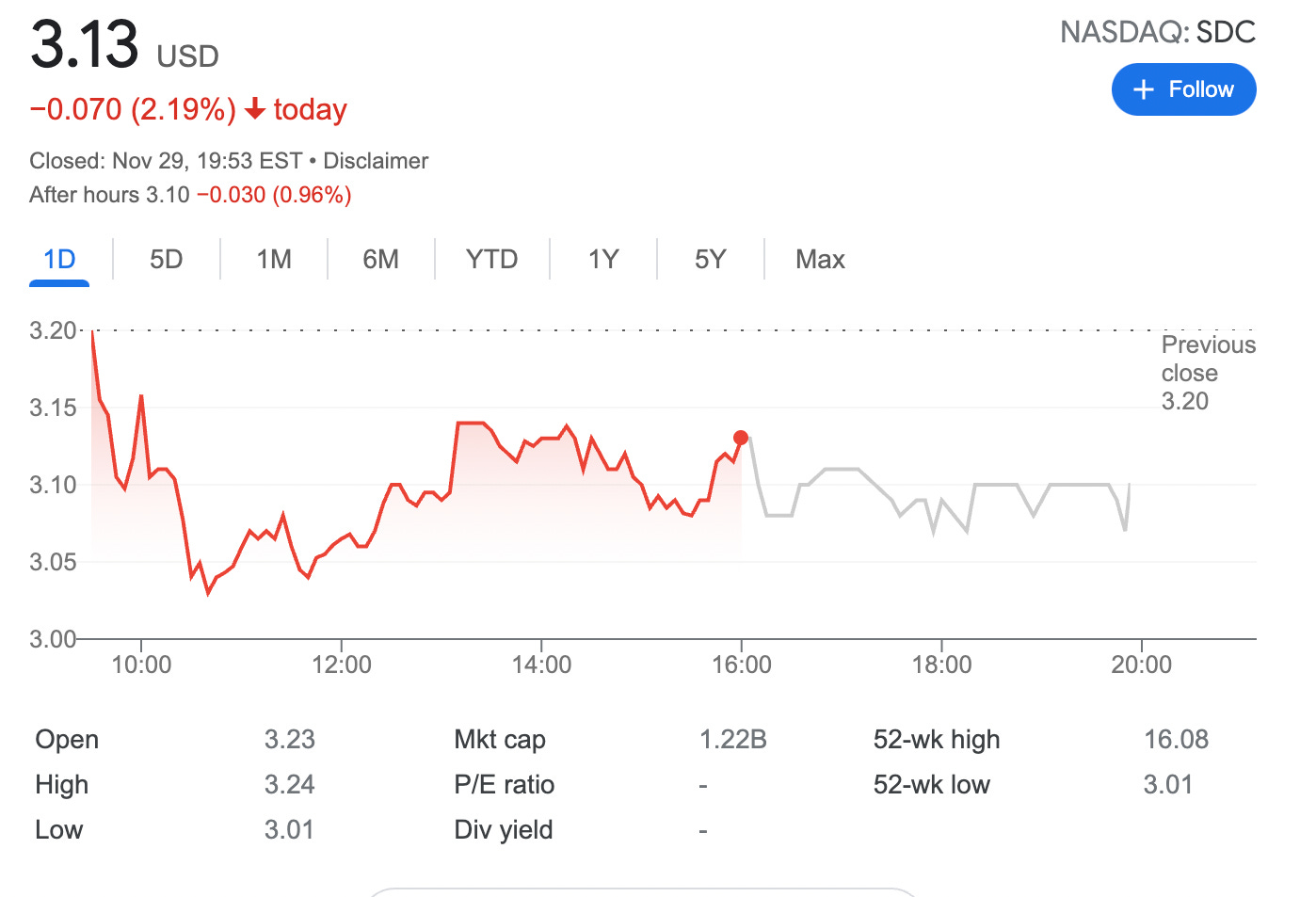

Trade Adjustment: Rolled Forward 2 SDC put options –10.6% potential income return in 269 days

On November 29, I decided to roll forward 2 put options on SDC stock by not changing strike prices.

SDC stock has been troubled a lot lately, not willing to take an assignment yet I decided to roll out

I've been into this trade since the end of July. Back then my short put strike price was $6.5, I have managed to roll it down to $5. Before letting me get assigned I decided to roll forward and squeeze some extra juice from this trade.

Here is the trade setup:

BOT 1 SDC DEC 17 '21 5 Put Option 2.09 USD

SLD 1 SDC APR 14 '22 5 Put Option 2.47 USD

Here I bought back 2 contracts with the strike prices of $5 and expiry December 17, 2021, for them, paid in total $418, and sold 2 new put options with the same strike price but with an expiry set on April 14, 2022 For this trade, I got $494 (before commissions)

What happens next?

On the expiry date, April 14, 2022, SDC is trading above $5 per share - options expire worthlessly and I keep premium - if SDC trades under $5 on the expiry date, I will get assigned 200 shares

New break-even price $5-$0.53 = $4.47

In case of assignment, will turn this trade into a wheel strategy and will start selling covered calls.