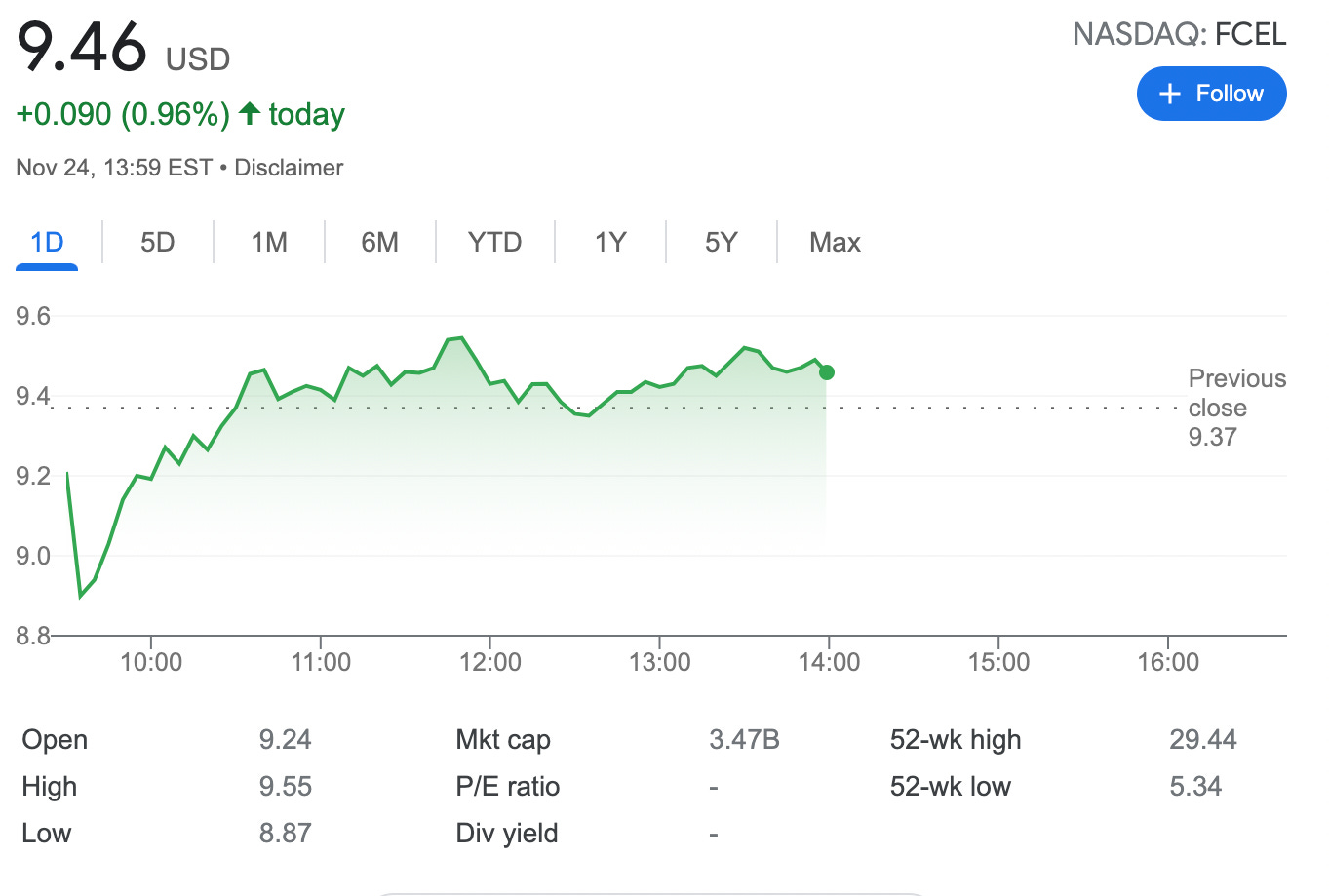

Trade Adjustment: Rolled 2 Credit spreads on FCEL – 3.06% potential income return in 71 days

On November 24, 2021, I rolled out and down 2 credit spread bull put options on FCEL stock with a new expiry set in the next 58 days on January 21, 2022. Also, I lowered my strike prices down to $9 and $7 (from $10 and $8)

The aftermath of this trade adjustment: $55.2 (after commissions)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

FuelCell Energy, Inc. is an American fuel cell power company. It designs, manufactures, operates, and services Direct Fuel Cell power plants that run on natural gas and biogas.

Here is the trade setup:

SLD 2 FCEL DEC 03 '21 - 10 + 8 Put Bull Spread -0.89

BOT 2 FCEL JAN 21 '22 - 9 + 7 Put Bull Spread -0.86

The aftermath of this trade, 55.2 USD (after commissions) or a 3.06% potential income return in 71 days, if options expire worthlessly

What happens next?

On the expiry date, January 21, 2022, FCEL is trading above $9 per share - options expire worthlessly and I keep premium - if FCEL trades under $9 on the expiry date, I risk getting assigned 200 shares and buying them for $1,800

But as I already have collected a premium of $0.27 per share, my break-even price for this trade then is $9-$0.27 = $8.73

In case of an assignment, I will turn this trade into a wheel, but prior to the assignment I will try to roll out this trade