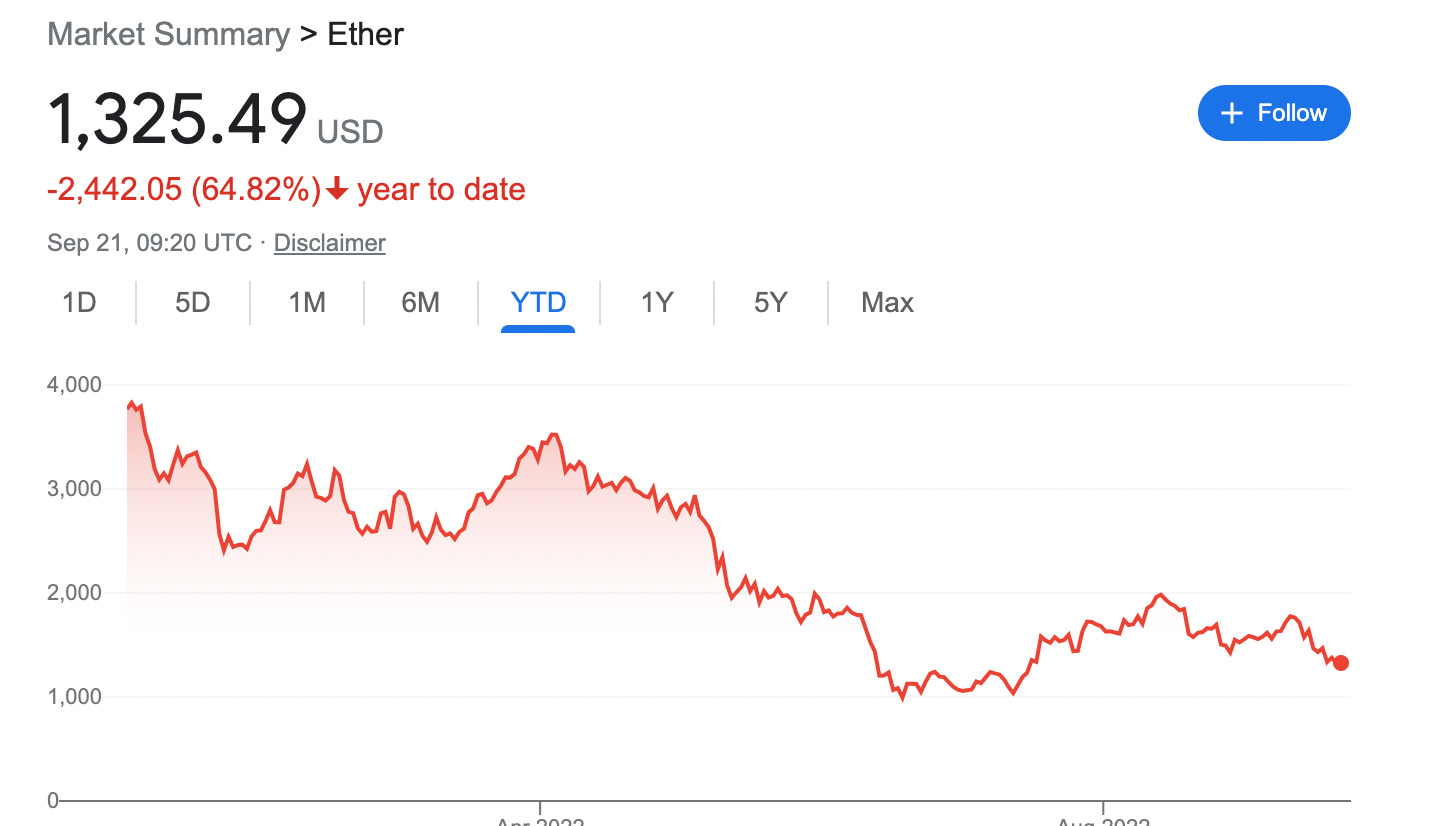

Sold Vertical Spread on Ethereum - potential income of 0.34% in 1 Day

On September 21, 2022, I sold 1 vertical spread on Ethereum cryptocurrency with an expiry tomorrow, September 22, 2022. For this trade, I got a premium of 0.0034 ETH / $4.51

Selling crypto options is pretty much the same as selling stock options, except they are settled in crypto, require less capital, are settled European style (cannot be assigned before the expiry), and can go totally wrong.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization. Ethereum was conceived in 2013 by programmer Vitalik Buterin.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset

Here is the trade setup:

ETH-22SEP22-1400-C trade open sell 0.0075

ETH-22SEP22-1450-C trade open buy 0.0035

For this trade, I got a premium of 0.0034 ETH (after commissions) or about 0.34% potential income return in just 1 day, if options expire worthlessly.

Unlike stock options, where the multiplier usually is 100, we can trade 1 ETH, 0.1 BTC

I actually don’t have 1 ETH, that’s why I opted for a vertical spread, I deposited about 0.17 ETH and sold a vertical spread with an idea behind it - if ETH will rise quickly my max loss will be limited to the long position.

What happens next?

On the expiry date, September 22, 2022, ETH is trading under $1,400 per coin - options expire worthlessly and I keep the premium and start over - if ETH trades above $1,400 on the expiry date, I pay the difference in crypto. Say ETH trades $1,420 on expiry, I need to pay the difference between the spot price and strike price, which is $20, or converted it back to ETH which would equal 0.014 ETH.

I would be left with 0.17+0.0034-0.014= 0.1594 ETH

In case of a challenged leg, I will try to roll it up and forward, as my goal right now is to grow my Ethereum holding to 1 coin, so I can sell covered calls (more premium)

Interested to learn more? I'm offering paid - online live course Selling Covered Call Options on Crypto (BTC/ETH/SOL)