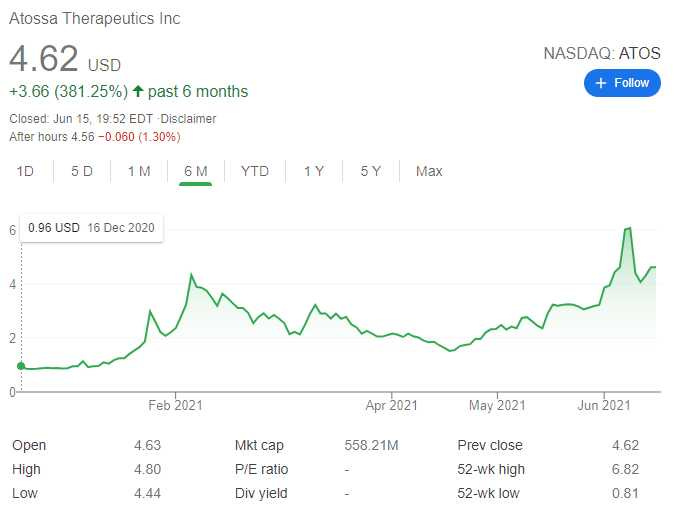

Sold 2 Credit Spreads on Atossa Therapeutics Inc (NASDAQ:ATOS) – 15.3% potential income return in 31 days

On June 15, 2021, I sold 2 bull put credit spreads on ATOS stock with an expiry set in the next 31 days. For this trade, we got a $122.40 premium (after commissions)

Atossa Therapeutics is a clinical-stage biopharmaceutical company focusing on breast cancer treatment and other breast conditions.

The current stock price and options premium for ATOS stock, kind of reminds me of BCRX stock a year ago, which I traded a lot in 2020.

This is the reason I entered this trade - a sentiment for a volatile biotech stock. lol

Here is our trade setup:

BOT 2 ATOS JUL 16 '21 - 4 + 2.5 Put Bull Spread -0.66 USD

For this trade, we got a premium of 122.40 USD (after commissions) or 15.3% potential income return in 31 days (if options expire worthlessly)

What happens next?

On the expiry date (July 16, 2021) ATOS is trading above $4 per share - options expire worthlessly and we keep premium, realizing our max potential from this trade. If ATOS trades under $4 on the expiry date, we get assigned.

But as we already have collected a premium of $0.61 per share, our break-even price for this trade then is $4-$0.61= $3.39

If assigned - will sell covered calls

As we are selling credit spreads, our max risk is defined, in case the stock will drop below $2.5, our second bought put will work as insurance and will minimize our potential losses.