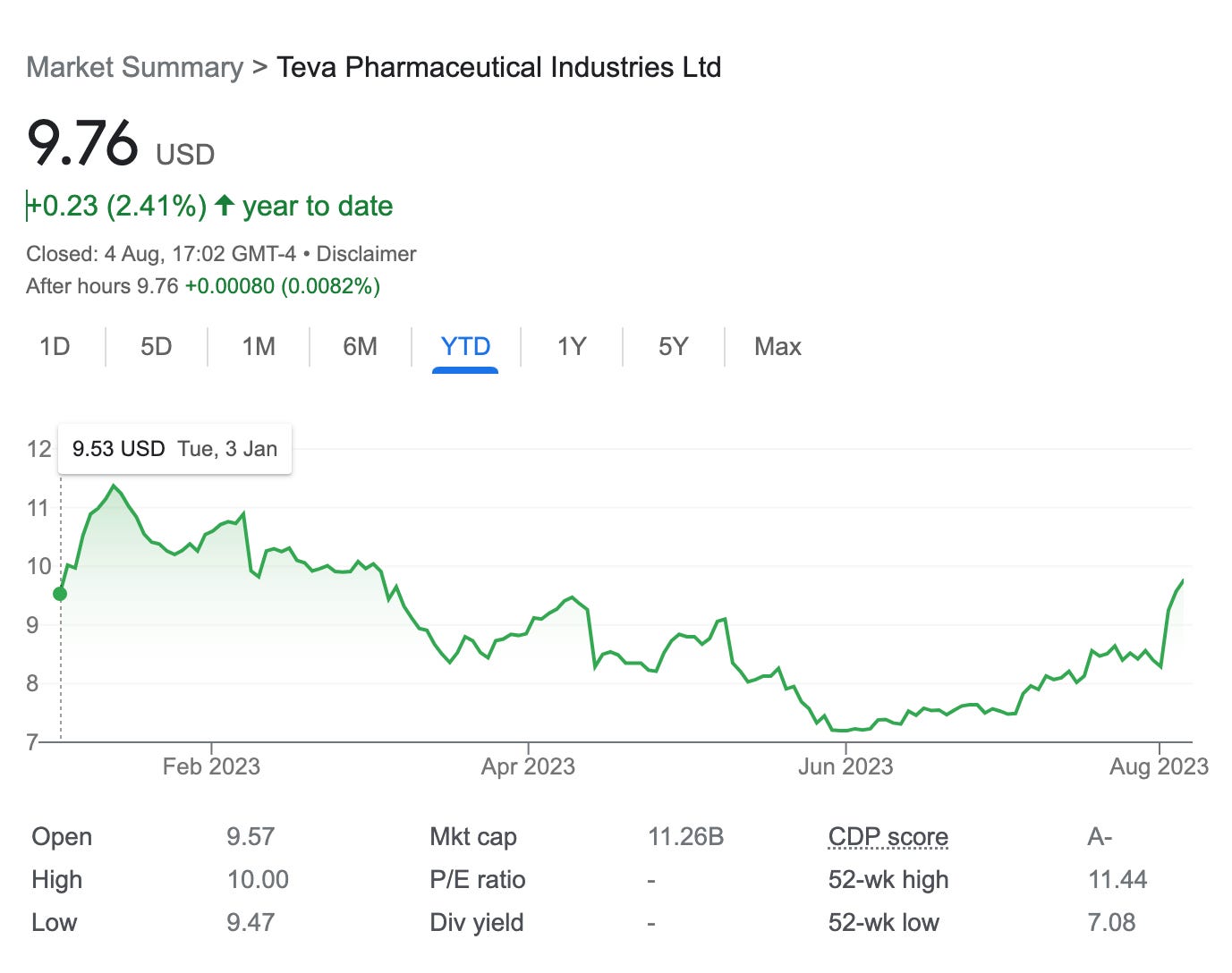

Sold 1 Put Option on TEVA Stock – 4.10% potential income return in 63 days (23.73% annualized)

On August 4, 2023, I sold an additional 1 put option on TEVA stock (NYSE:TEVA) with a strike price of $9.5 and expiry on September 22, 2023. For this trade setup, I was rewarded with $24 (after commissions).

I sold this put option after my previous expired worthless, originally I’ve been in this trade since July 21,

Teva Pharmaceutical Industries Ltd. is an Israeli multinational pharmaceutical company with headquarters in Tel Aviv, Israel. It specializes primarily in generic drugs, but other business interests include active pharmaceutical ingredients and, to a lesser extent, proprietary pharmaceuticals.

From the premium received, I bought additional 2 shares of TEVA stock itself for our long-term stock portfolio. We are holding already 4 in the portfolio. 96 to go, before starting to sell covered calls

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 TEVA SEP 22 '23 9.5 Put Option 0.25 USD

What happens next?

On the expiry date, September 22, 2023, TEVA is trading above $9.5 per share - options expire worthlessly and I keep premium - if TEVA trades under $9.5 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $9.5

As I already have collected a premium of $0.14+0.24 per share, my break-even price for this trade is $9.5-$0.14-$0.24= $9.12

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 4 trades since July 21, 2023

Options premium: $39