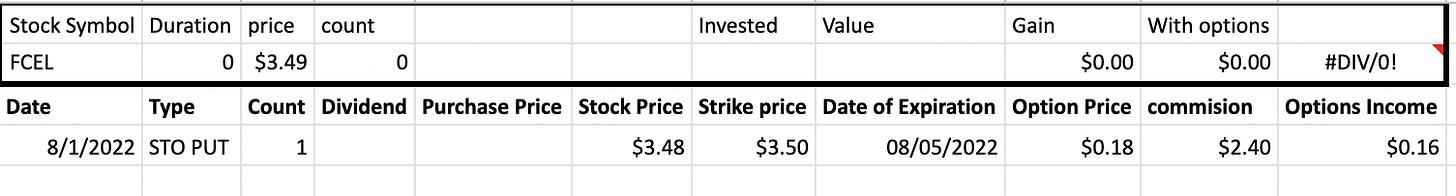

Sold 1 Put Option on NASDAQ:FCEL – 4.45% potential income return in 4 days

On August 01, 2022, I sold 1 put option on NASDAQ: FCEL stock with an expiry set in the next 4 days (August 0.5). For this trade, I got a premium of $15.6 (after commissions)

FuelCell Energy, Inc. is a publicly traded fuel cell company, headquartered in Danbury, Connecticut. It designs, manufactures, operates, and services Direct Fuel Cell power plants.

Why did I place this trade?

Before entering this trade I was actually looking on buy/write (buying stock and selling a call option) but decided I could use put options instead before getting assigned.

Double checked there is no earnings report before the options expiry

The stock seems to be trading close to its bottom

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 FCEL Aug05'22 3.5 PUT 0.18 USD

For this credit spread, I got a credit of 15.6 USD (after commissions) or about 4.45% potential income return in 4 days, if options expire worthlessly

What happens next?

On the expiry date, August 05, 2022, FCEL is trading above $3.5 per share - options expire worthlessly and I keep a premium - if FCEL trades under $3.5 on the expiry date, I will get assigned 100 shares, and will have to buy them paying $350

Break-even price: $3.5-0.15= $3.35

If the options contract is going to expire worthlessly I will proceed with another put option. In case of an assignment, I will happily start selling covered calls on this position.

Running Total 1 Trade since August 1, 2022

Options income: $16