Sold 1 Put Option on German E.ON- 2% potential gain in 11 days

Happy Labors day, hope you had time to relax!

While US stock markets were closed today, I decided to trade in European.

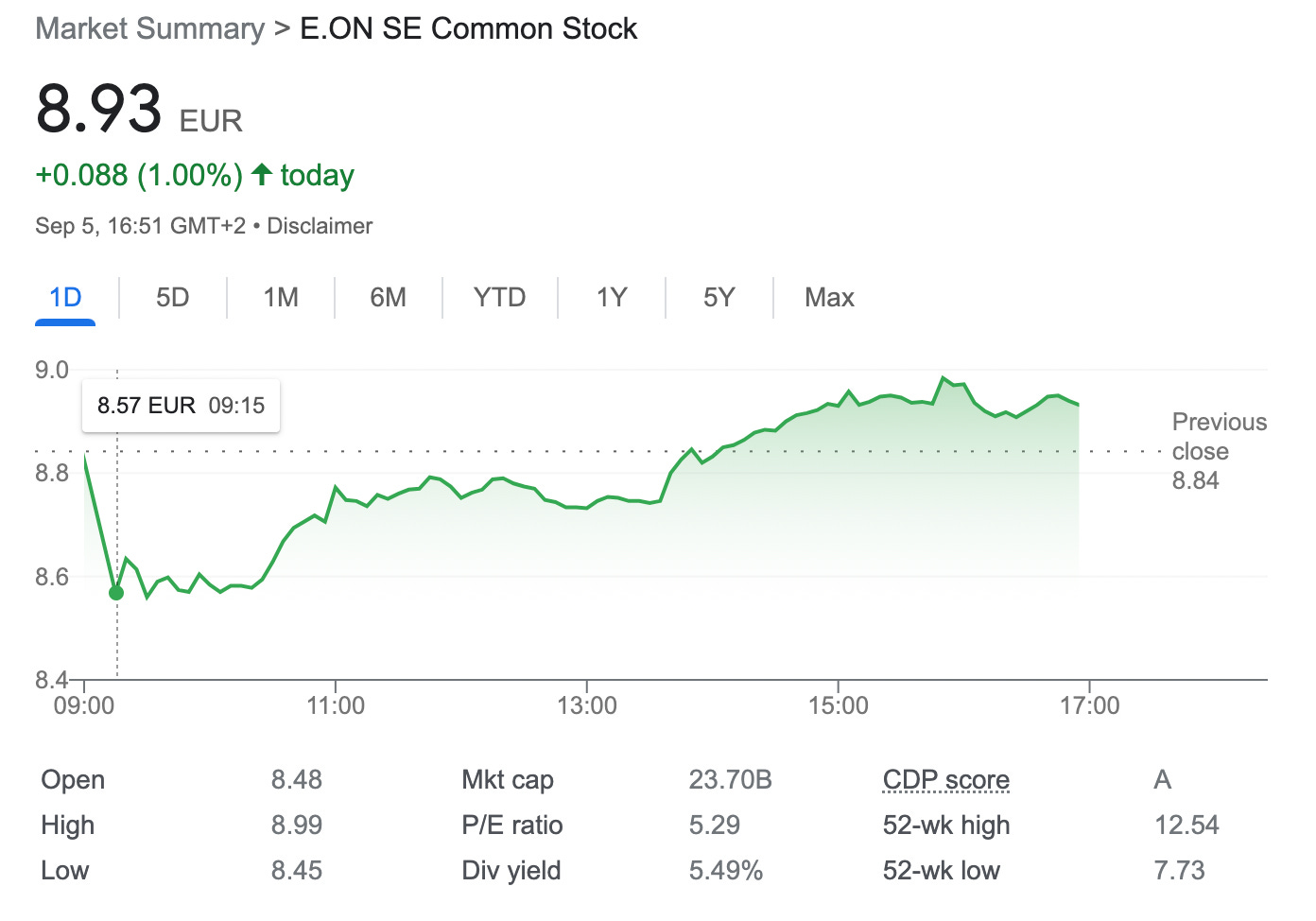

On September 5th, 2022, I sold 1 put option on E.ON German multinational utility company with a strike price of EUR 8.4 and expiry on September 16, 2022. Credit received EUR 18 ( before commissions)

E.ON SE is a European electric utility company based in Essen, Germany. It runs one of the world's largest investor-owned electric utility service providers. The name comes from the Latin word aeon, from the Greek aion which means age.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 EOAN IBIS Sep16'22 8.4 PUT @ 0.18EUR

For this trade, I got a premium of EUR 17.21 (after commissions) or 2.02% potential income return in 11 days (if options expire worthlessly)

What happens next?

On the expiry date, September 16, 2022, EOAN is trading above EUR 8.4 per share - options expire worthlessly and I keep premium and start over - if EON trades below EUR 8.4 on the expiry date, I will get assigned 100 shares.

Break-even price: EUR 8.4-EUR 0.17= EUR 8.23

In case of an assignment, I will turn this trade into a covered call