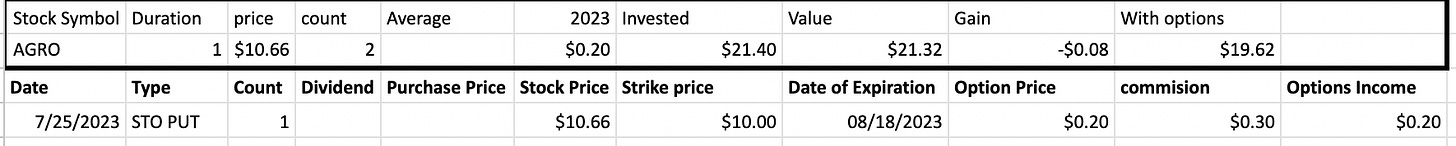

Sold 1 Put Option on AGRO Stock – 1.97% potential income return in 24 days (29.94% annualized)

On July 25, 2023, I sold 1 put option on AGRO stock (NYSE:AGRO) with a strike price of $10 and expiry on August 18, 2023. For this trade setup, I was rewarded with $19.7 (after commissions).

Adecoagro S.A. operates as an agro-industrial company in South America. The company mainly operates through three segments: Farming; Sugar, Ethanol and Energy; and Land Transformation. It engages in farming crops, rice and other agricultural products, dairy operations, and land transformation activities, as well as sugar, ethanol, and energy production activities

From the premium received, I bought 2 shares of AGRO stock itself for our long-term stock portfolio. AGRO is a dividend payer and these 2 shares will boost our portfolio by 0.54 USD / yearly. Not the biggest addition, but every cent counts.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 AGRO AUG 18 '23 10 Put Option 0.2 USD

What happens next?

On the expiry date, August 18, 2023, AGRO is trading above $10 per share - options expire worthlessly and I keep premium - if AGRO trades under $10 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $1,000

As I already have collected a premium of $0.19 per share, my break-even price for this trade is $10-$0.19= $9.82

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 2 trades since July 25, 2023

Options premium: $20