Sold 1 Credit Spread on GOLD – 1.64% potential income return in 31 days

I hope you have been enjoying the wild ride in the stock market this January.

I haven’t traded much lately, mostly adjusted existing trades, but today is one of the rare days my portfolio is up, despite SPX being down by almost -2% and I’m not under the water, not facing margin calls. Awesome.

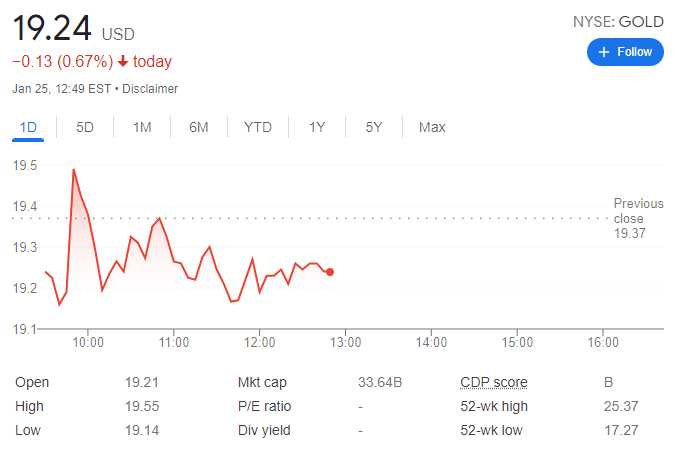

I decided to open a new position at Barrick Gold Corporation.

On January 25, 2022, I sold 1 bull put credit spread on NYSE: GOLD stock with an expiry set in the next 31 days. For this trade, I got a premium of $31.20 (after commissions)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada.

I’ve traded with some good success Barrick Gold in the past and I feel confident if assigned

Here is the trade setup:

SLD 1 GOLD FEB 25 '22 19 Put Option 0.72 USD

BOT 1 GOLD FEB 25 '22 18 Put Option 0.36 USD

For this credit spread, I got a credit of 31.2 USD (after commissions) or a 1.64% potential income return in 31 days, if options expire worthlessly

What happens next?

On the expiry date, February 25, 2022, GOLD is trading above $19 per share - options expire worthlessly and I keep premium - if GOLD trades under $19 on the expiry date, I risk getting assigned 100 shares and will have to buy them for $1,900

Before possible assignment, I will try to roll out this trade for credit.

As I already have collected a premium of $0.31 per share, my break-even price for this trade then will be $19-$0.31 = $18.69

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Trade safe!