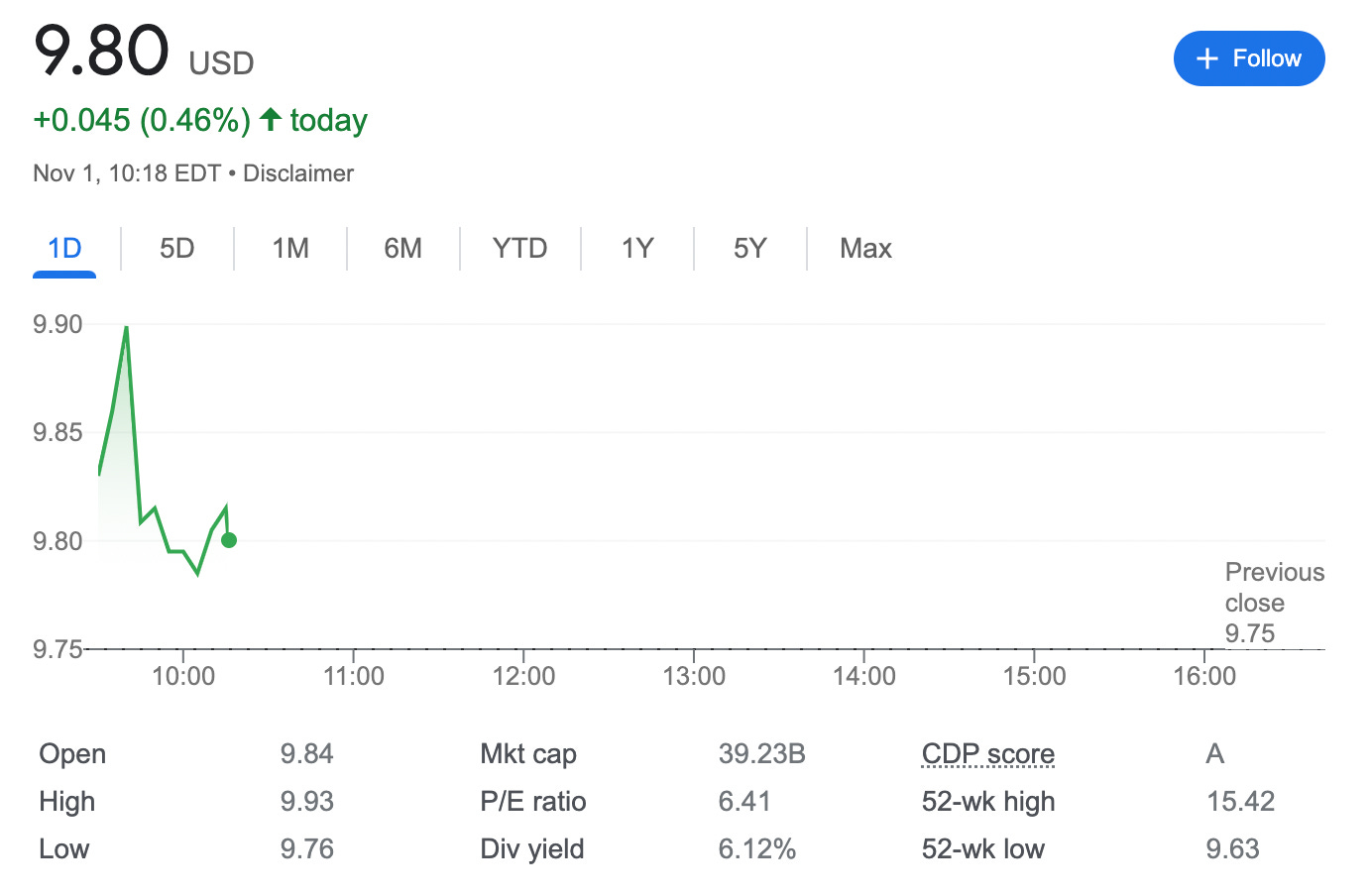

Short strangle on F stock (Recovery trade after getting assigned put option at 14)

On November 1, 2023, I got assigned 100 shares with F stock at 14. A position I originally started back in July 2023.

My loss before options income form the position is $420, but as I have made options premium of $67, my actual break even price is $13.37.

As I’m unable to sell above my current break even price to receive enough premium, I decided to sell a covered call option near the strike price + sell additional put option for additional premium - forming the so called short strangle

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

Assigned 100 shares at 14

SLD 1 F Nov24'23 10.5 CALL 0.11

SLD 1 F Nov24'23 9.5 PUT 0.19

What happens next?

On the expiry date, November 24, 2023, F is trading under $10.5 but above $9.5 per share - options expire worthlessly and I keep premium - if MO trades under $9.5 on the expiry date, I risk getting assigned additional 100 shares and will have to buy them paying $950. If so i will hold already 200 shares with F, but my average buy price will be $11.75. Already better.

In case F trades above $10.5, I risk my 100 shares getting called away and book actual loss of $243. Which also is better than current loss of $353.

Anyhow, If challenged any of the sides - I will try to roll them forward for credit.

As I already have collected a premium of $0.94 per share, my break-even price for this trade is $14-$0.94= $13.04

In total: 12 trades since June 15, 2023

Options premium: $155