Rolled Forward UWMC Covered Call +12.6% potential income return in 83 days

On November 19, 2021, I rolled forward 1 covered call on UWMC stock, a position I originally established at the start of October by investing $682, see: Established New Covered Call on UWMC; Potential Income return 3.9% in 7 days

United Wholesale Mortgage (NYSE: UWMC) is the wholesale mortgage lender

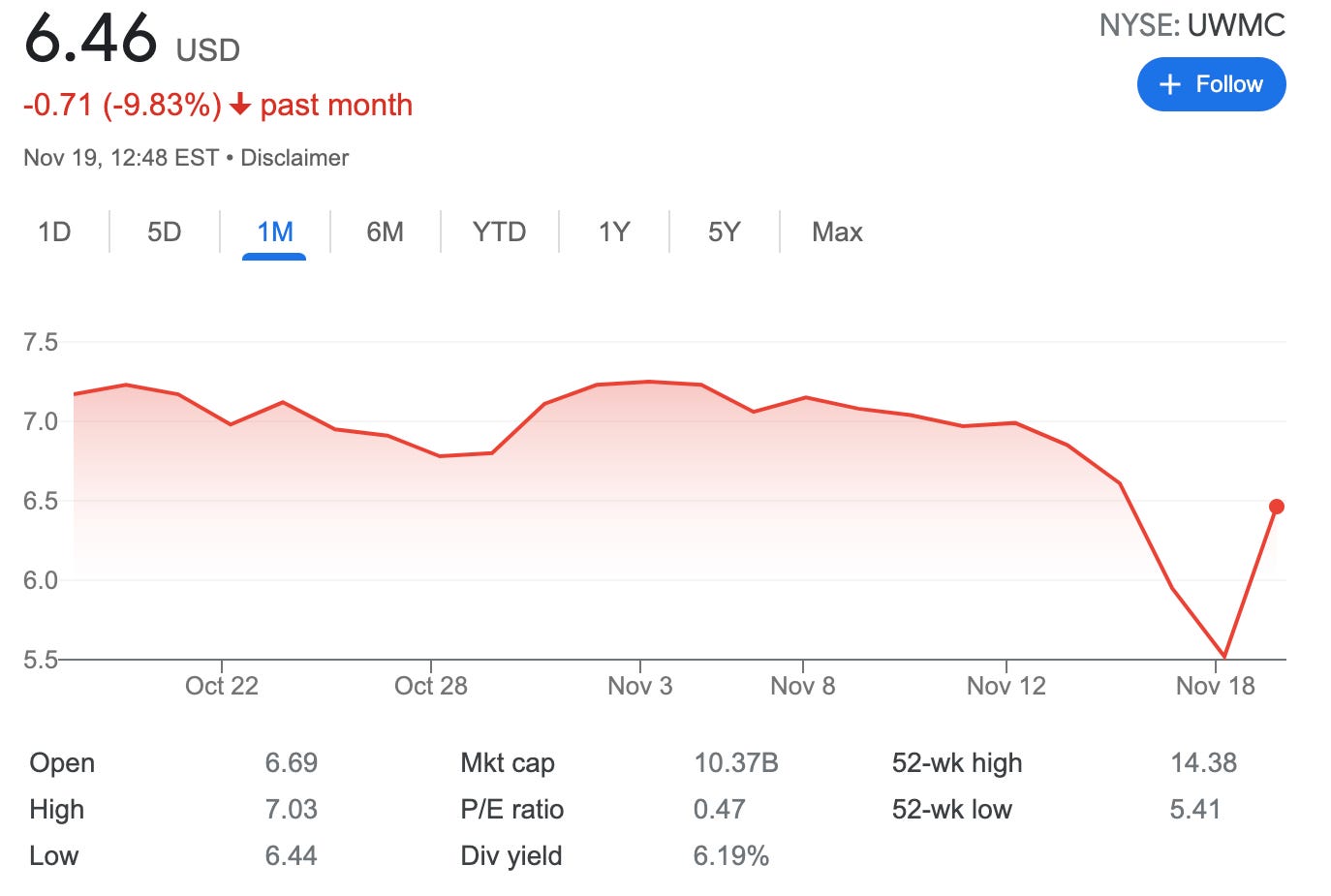

for most of the time while holding today’s options, the stock was trading above $7 per share, but yesterday it dropped to $5.5 (was heavily shorted) and today bounced back to $6.5. I decided to take advantage and roll this covered call to December 23, 2021

here is the trade setup:

BOT 1 UWMC NOV 19 '21 7 Call Option 0.05 USD

SLD 1 UWMC DEC 23 '21 7 Call Option 0.50 USD

here I bought back today’s expiry call option paying $5 and sold a new call option with expiry on December 23, 2021, receiving $50 (before commissions)

What happens next?

On the expiry date, December 23, 2021, UWMC is trading under $7 per share - options expire worthlessly and I keep premium - if UWMC trades above $7 on the expiry date, my 100 shares will get called away and I realize my max profit $86 or potential income return 12.6% yield in 83 days.

Break-even price: $6.82-$0.68= $6.14

I prefer selling options on stable dividend stocks, in that manner collecting both dividend and option premium. Let’s hope - UWMC is stable enough.