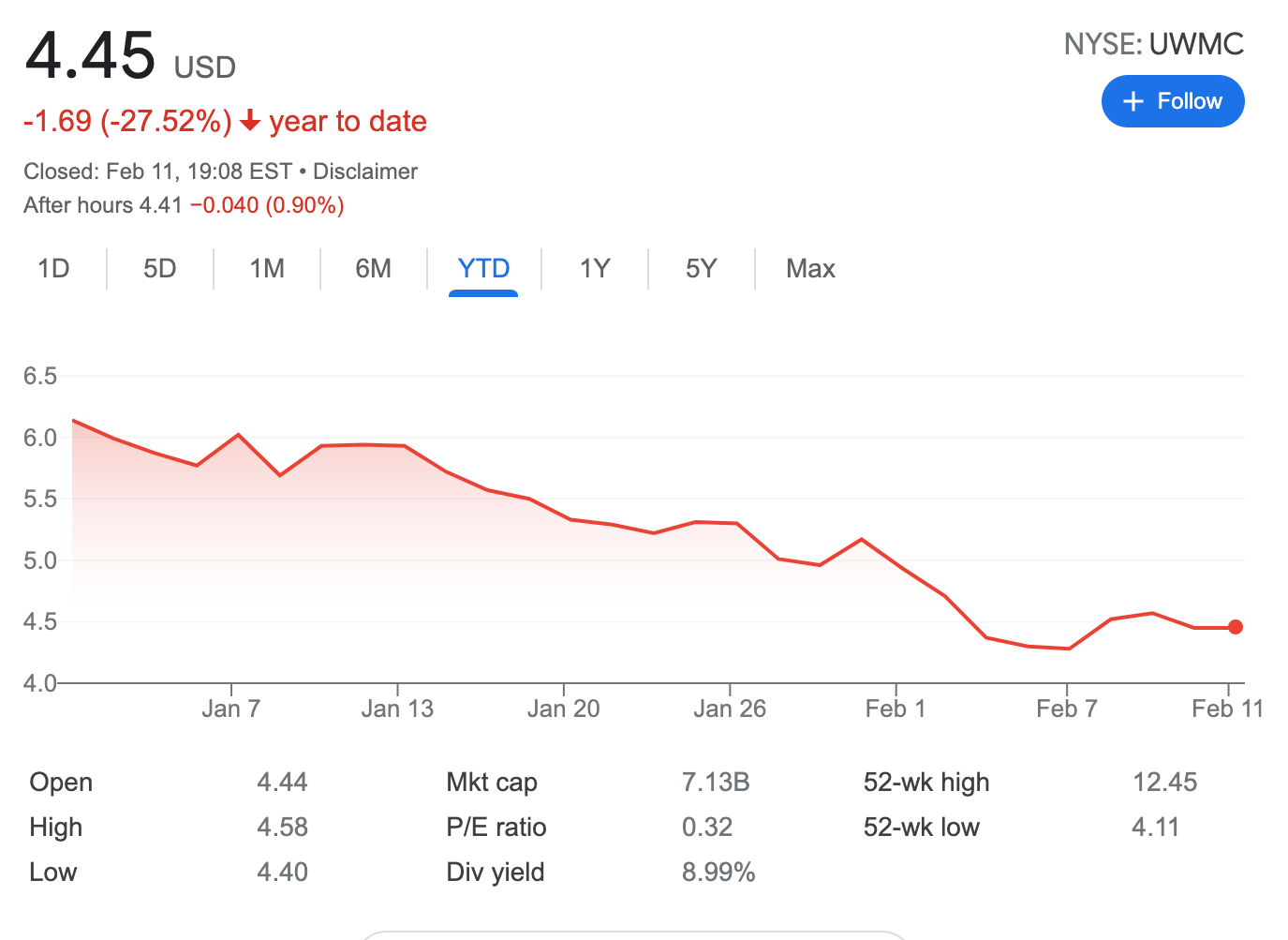

Rolled Forward UWMC Covered Call -17.8% potential income loss in 136 days

On February 11, 2022, I rolled forward 1 covered call on UWMC stock, a position I originally established at the start of October 2021 by investing $682, see: Established New Covered Call on UWMC; Potential Income return 3.9% in 7 days

United Wholesale Mortgage (NYSE: UWMC) is the wholesale mortgage lender

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

We are significantly under the water with UWMC stock this year

here is the trade setup:

BOT 1 UWMC Feb11'22 4.5 CALL 0.05 USD

SLD 1 UWMC Feb18'22 4.5 CALL 0.19 USD

here I bought back today’s expiry 4.5 call and sold new, next Friday’s (February 18, 2022) expiry call option. In total receiving $14 (before commissions)

What happens next?

On the expiry date, February 18, 2022, UWMC is trading under $4.5 per share - options expire worthlessly and I keep premium - if UWMC trades above $4.5 on the expiry date, my 100 shares will get called away and I realize a loss of $121.4 or potential income loss of -17.8% in 136 days.

Break-even price: $6.82-$1.03= $5.79

Let’s see will I be able to recover this trade.