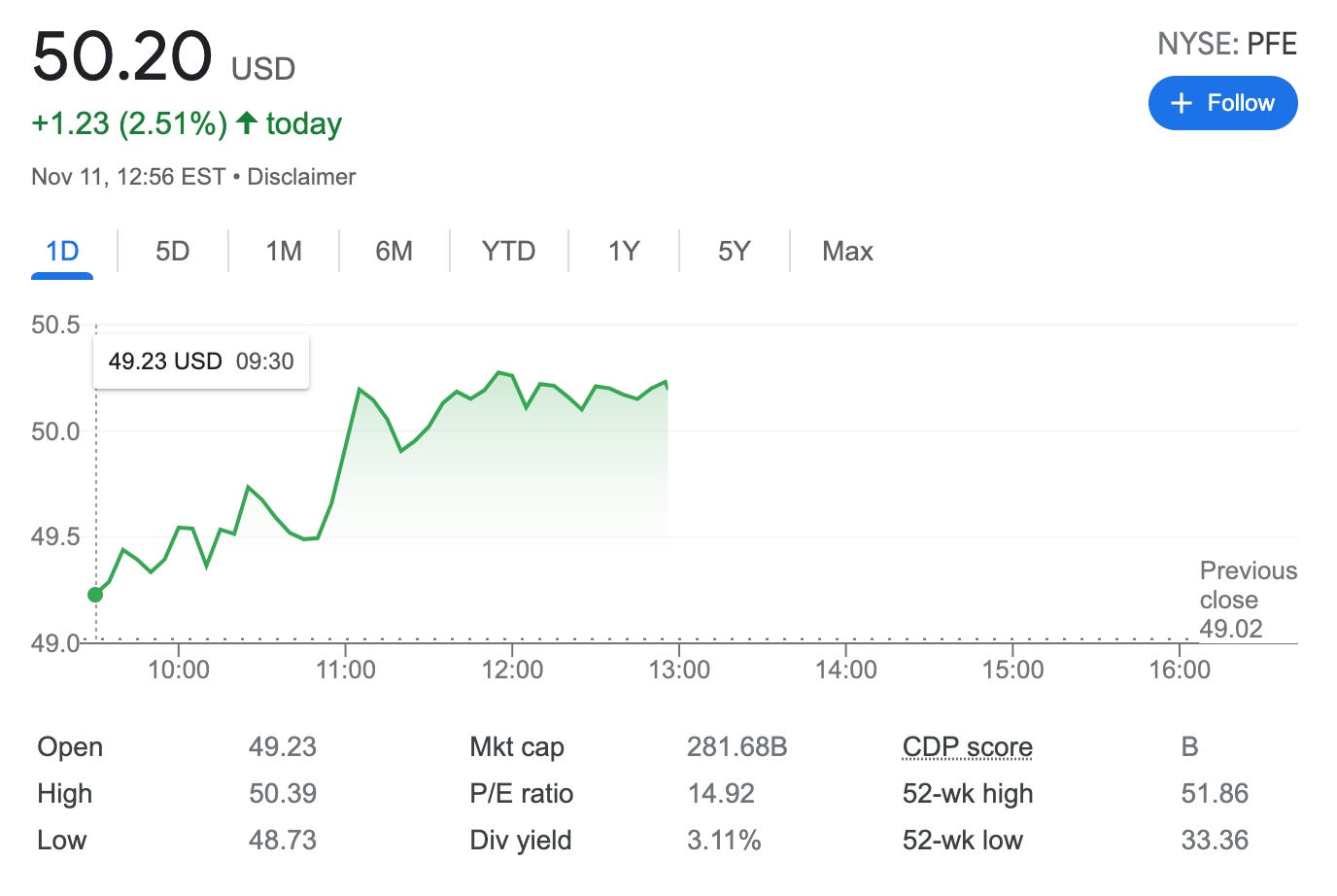

Rolled Forward PFE Covered Call +1.84% potential income return in 38 days

On November 11, 2021, I rolled forward 1 covered call on PFE stock, a position I originally established at the start of November by investing $44.95.

See: Established New Covered Call on PFE to Capture Dividend

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German immigrants, Charles Pfizer and his cousin Charles F. Erhart.

here is the trade setup:

BOT 1 PFE NOV 12 '21 45 Call Option 4.41 USD

SLD 1 PFE DEC 10 '21 45 Call Option 4.71 USD

What happens next?

On the expiry date, December 10, 2021, PFE is trading under $45 per share - options expire worthlessly and I keep premium - if PFE trades above $45 on the expiry date, my 100 shares will get called away and I realize my max profit $83 ($5+$78) or potential 1.84% yield in 38 days. e

Break-even price: $44.95-$0.78= $44.17