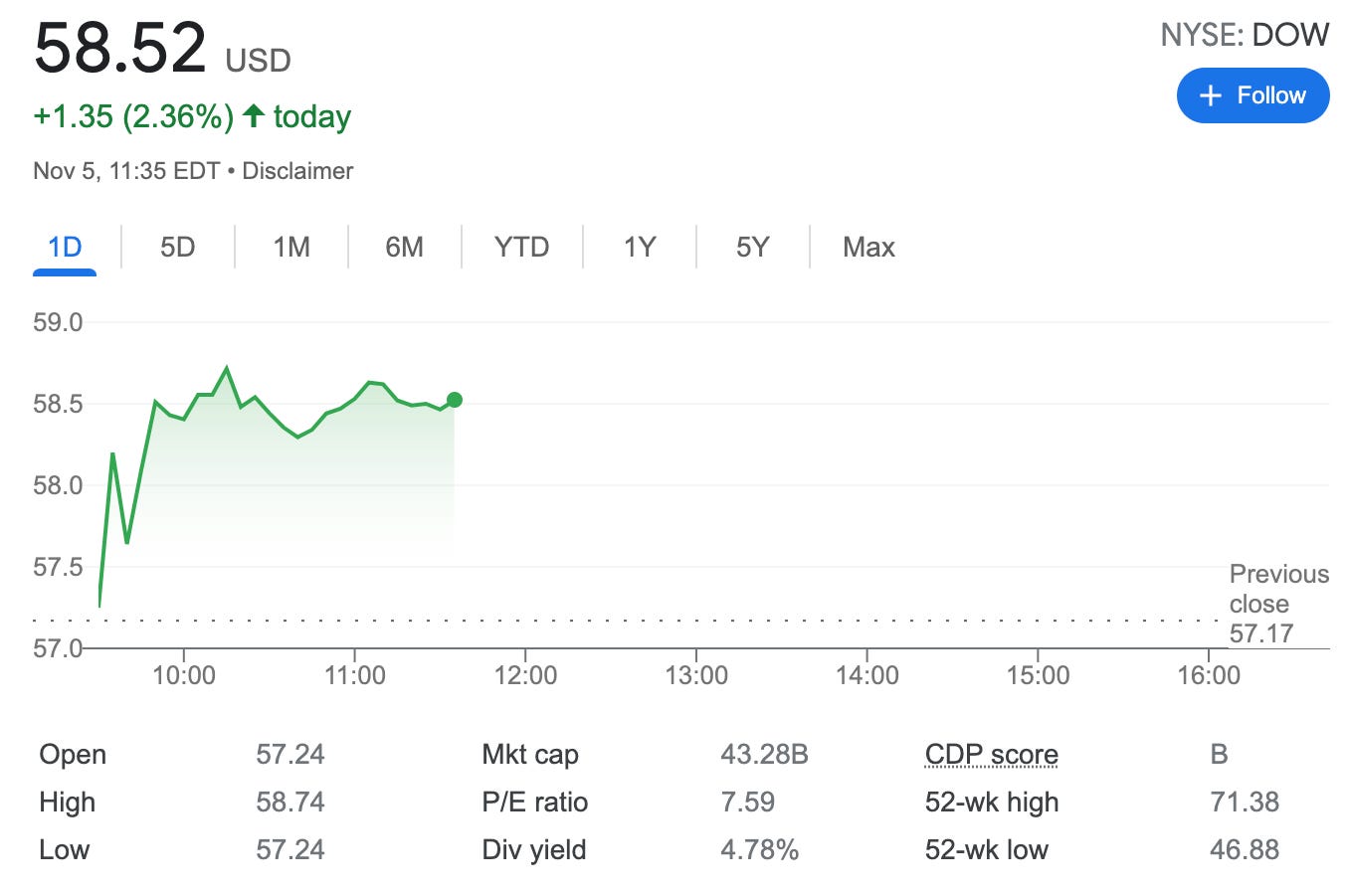

Rolled Forward and Up Dow Inc Covered Call +4.1% potential income return in 42 days

On November 05, 2021, I rolled forward and up 1 covered call on Dow inc. stock, a position I originally established at the start of October by investing $5,850.

See Established New Covered Call on Dow Inc.

Dow Inc. is an American commodity chemical company. It was spun off DowDuPont on April 1, 2019, at which time it became a public company and was added to the Dow Jones Industrial Average. The company is headquartered in Midland, Michigan.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

BOT 1 DOW NOV 05 '21 58 Call Option 0.59 USD

SLD 1 DOW NOV 19 '21 59 Call Option 1.03 USD

What happens next?

On the expiry date, November 19, 2022, DOW is trading under $59 per share - options expire worthlessly and I keep premium - if DOW trades above $59 on the expiry date, my 100 shares will get called away and I realize my max profit $240 ($50+$190) or potential 4.1% yield in 42 days.

Break-even price: $58.5-$1.90= $56.6