Rolled Forward and Down 1 Put option on BTI – 4.6% potential income return in 218 days (7.68% annualized)

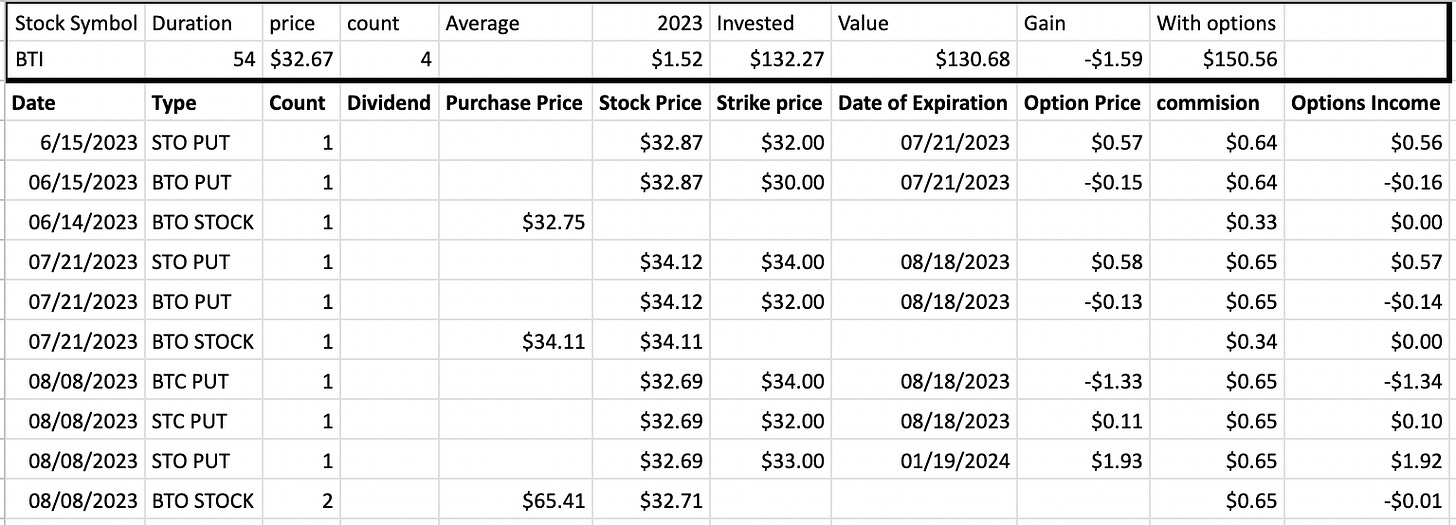

On August 8, 2023, I rolled forward and down 1 put option on British American Tobcco stock company, a position I originally established on June 15, 2023

I rolled because my strike price of $34 was in the money and the expiry date (August 18) was approaching. I didn’t want to take an assignment yet and decided to roll down this position, while still squeezing out some extra juice (premium)

From the premium received, I bought an additional 2 shares of BTI stock itself. 96 to go, before I will be able to establish covered call options for this position. BTI is a dividend-paying stock, with a yield above 7%. Two additional shares will boost our dividend stock portfolio by $4.76. Awesome.

here is the trade setup:

BOT 1 BTI AUG 21 '23 34 Put Option 1.33 USD

SLD 1 BTI AUG 18 '23 32 Put Option 0.11 USD

SLD 1 BTI JAN 19 '24 33 Put Option 1.93 USD

What happens next?

On the expiry date, January 19, 2024, BTI is trading above $33 per share - options expire worthlessly and I keep premium - if BTI trades under $33 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $3,300.

As I already have collected a premium of $1.52 per share, my break-even price for this trade is 33-1.52 = $31.48

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 10 trades since June 15, 2023

Options premium: $152