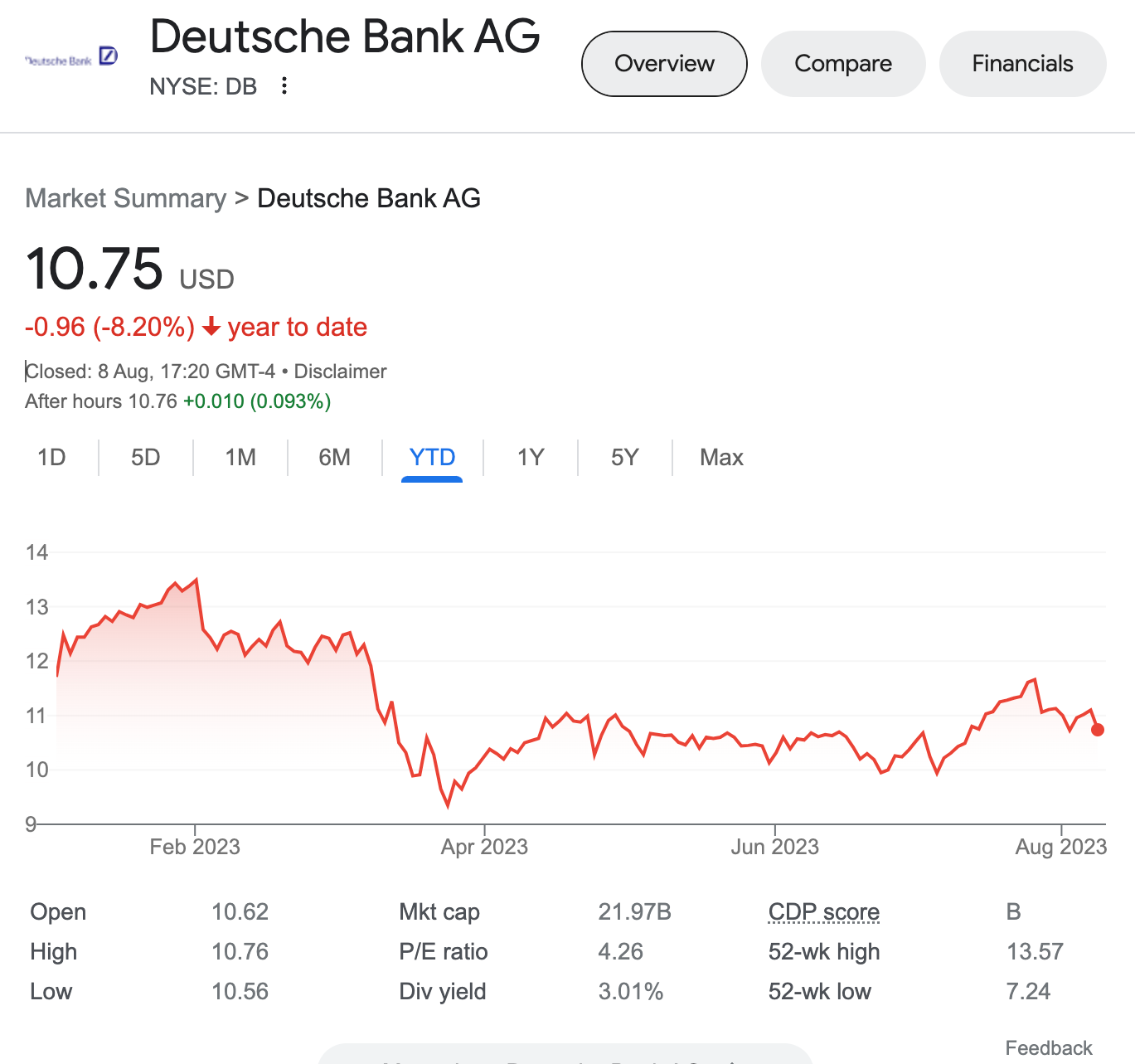

Rolled Forward and Down 1 Put option on DB – 4.7% potential income return in 197 days (8.69% annualized)

On August 8, 2023, I rolled forward and down 1 put option on Deutsche Bank stock company, a position I originally established on July 6, 2023

I rolled because my strike price of $11 was in the money and the expiry date (August 18) was approaching. I didn’t want to take an assignment risk before the expiry and decided to roll down this position, while still squeezing out some extra juice (premium)

Deutsche Bank AG, sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange.

From the premium received, I bought additional 2 shares of DB stock itself for our long-term stock portfolio. DB also is a dividend payer, this little addition will boost the portfolio by $0.56 yearly. Amazing!

We are now holding 5 shares with GPS in our stock portfolio, 95 to go before will start selling covered calls to generate extra income.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

BOT 1 DB Aug25'23 11 PUT 0.42

SLD 1 DB Jan19'24 10 PUT 0.62

What happens next?

On the expiry date, January 19, 2024, DB is trading above $10 per share - options expire worthlessly and I keep premium - if DB trades under $10 on the expiry date, I risk getting assigned 100 shares and will have to buy them paying $1,000

As I already have collected a premium of $0.47 per share, my break-even price for this trade is $10-$0.47= $9.53

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 8 trades since July 6, 2023

Options premium: $47