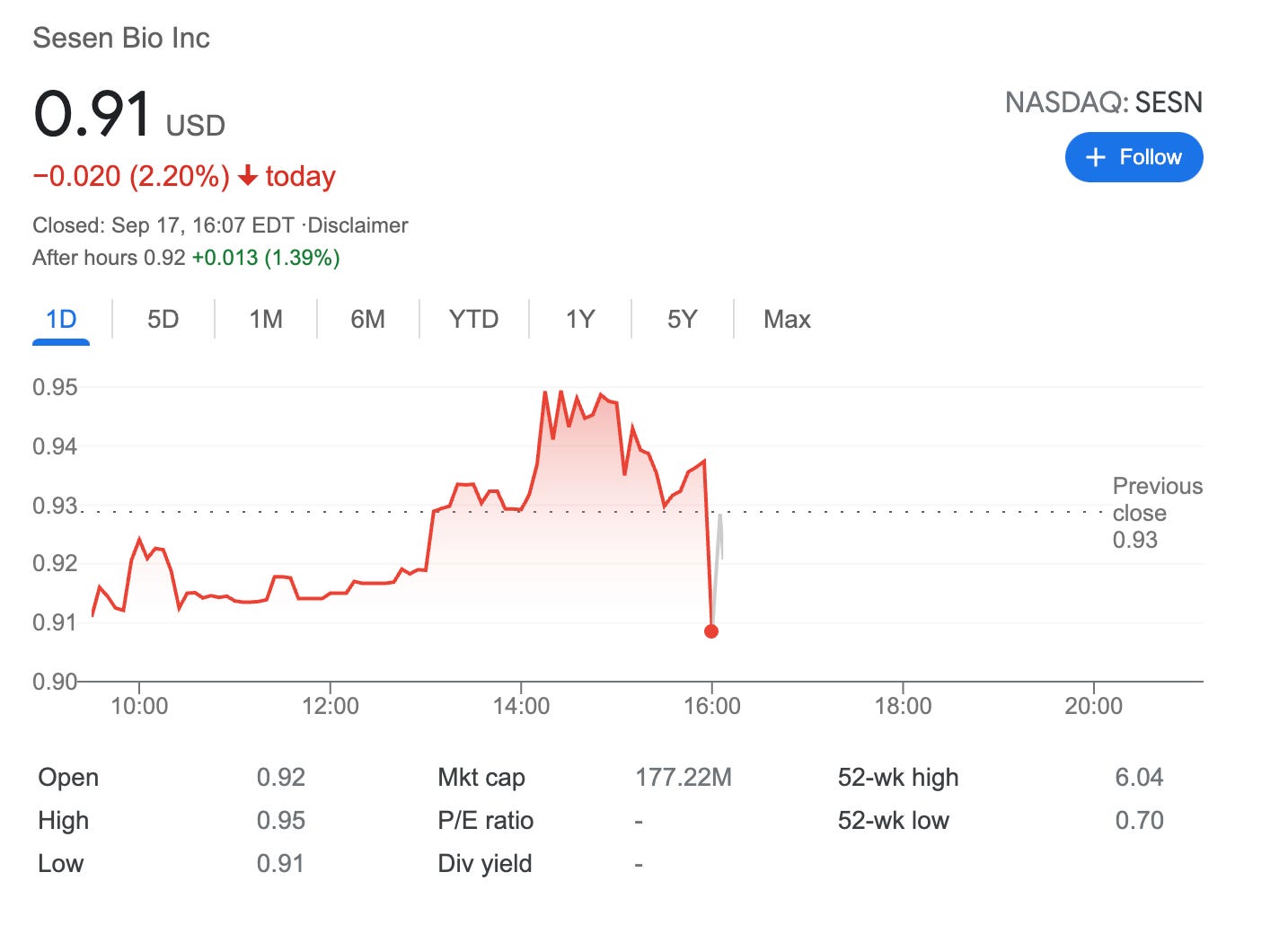

Rolled Forward and down 1 Covered Call on SESN; Potential Income loss 77% in 70 days

On September 17, 2021, I rolled forward 1 covered call on SESN stock expiring on October 15. For this trade, I got $8 (before commissions)

Originally this trade was opened on August 9, 2021, as a credit spread. 7 credit spreads with expiry still set in September, but apparently, some decided to use his rights and exercised 100 shares. Well, that's how it works.

Here is the trade setup:

SLD 1 SESN OCT 15 '21 1 Call Option 0.08 USD

It was hard to receive any decent premium here, but I still feel glad getting those 8 bucks here

What happens next?

On the expiry date, October 15, 2021, SESN is trading under $1 per share - options expire worthlessly and I keep premium - if SESN trades above $1 on the expiry date, my 100 shares will get called away and I will get $100

My new break-even price for this trade: $1.77 (in case my shares will get called away I will lose $77 in this trade)

Let’s hope the company doesn’t file for bankruptcy (but this doesn’t seem the case). I guess it might take about one year sitting in this trade and hopefully breaking even. Will see.