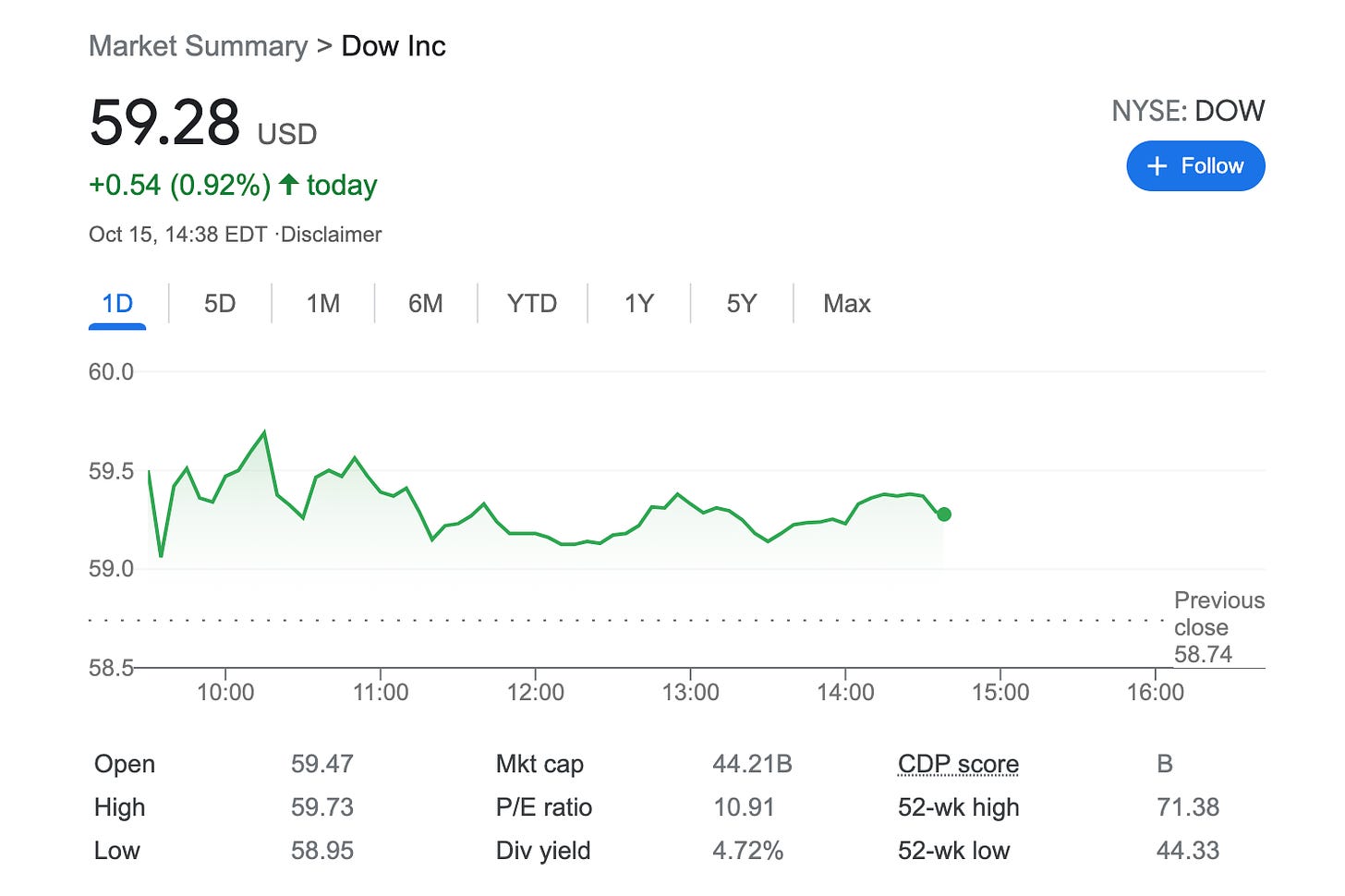

Rolled Forward an Up Dow Inc Covered Call +3.99% potential income return in 14 days

On October 15, 2021, I rolled forward and up 1 covered call on Dow inc. stock, a position I originally established a week ago by investing $5,850. See Established New Covered Call on Dow Inc.

As my strike price of $59 got touched I decided not to let this stock get called away, it was agreed to roll up and forward this call option for additional credit and upside potential

here is the trade setup:

BOT 1 DOW OCT 15 '21 59 Call Option 0.59 USD

SLD 1 DOW OCT 22 '21 60 Call Option 0.89 USD

Here I bought back October 15 expiry call option with a strike price set of $59, by paying $59 and sold next week’s expiry call option with a higher ($60) strike price from who I got a premium of $89

What happens next?

On the expiry date, October 15, 2022, DOW is trading under $60 per share - options expire worthlessly and I keep premium - if DOW trades above $60 on the expiry date, my 100 shares will get called away and I realize my max profit $$233.8 ($150+$83.8) or potential 3.99% yield in 14 days.

Break-even price: $58.5-0.83= $57.67