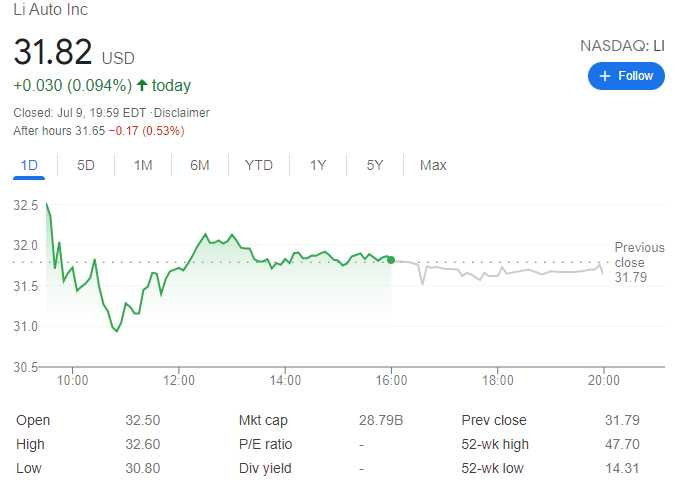

Roll Forward Covered Call on Li auto stock (NASDAQ:LI) - Potential income return +4.51% in 17 days

On July 09, 2021, we rolled forward 1 covered call on the LI auto stock (NASDAQ:LI) with a new expiry date set on July 16, 2021. The aftermath of this trade: +$34.6 (after commissions)

We have been in this trade since June 29, when we bought 100 shares at $33.80, see: New Covered Call on Li auto stock (NASDAQ:LI) - Potential income return +2.69% in 3 days

With the LI auto stock price hovering just below our strike price of $34 I decided to roll this call option into the next week for credit.

LI auto stock has been very volatile and speculative (premiums are great) during the last 6 months.

here is our trade setup:

SLD 1 LI JUL 16 '21 34 Call Option 0.35 USD

what can happen next:

Li is trading below our strike price of $34 at the expiry date (Jul 16, 2021), in this case, we keep the premium and sell more covered calls to lower our cost basis.

In case the LI stock is trading above our strike price of $34, our 100 shares get called away at the strike price of $34, and we realize our max gain +$152.6 or 4.51% potential return of income in 17 days

Break-even: $32.48