Partial Roll Forward and Down 3 Credit Spreads on ACB +8.49% potential income return in 91 days

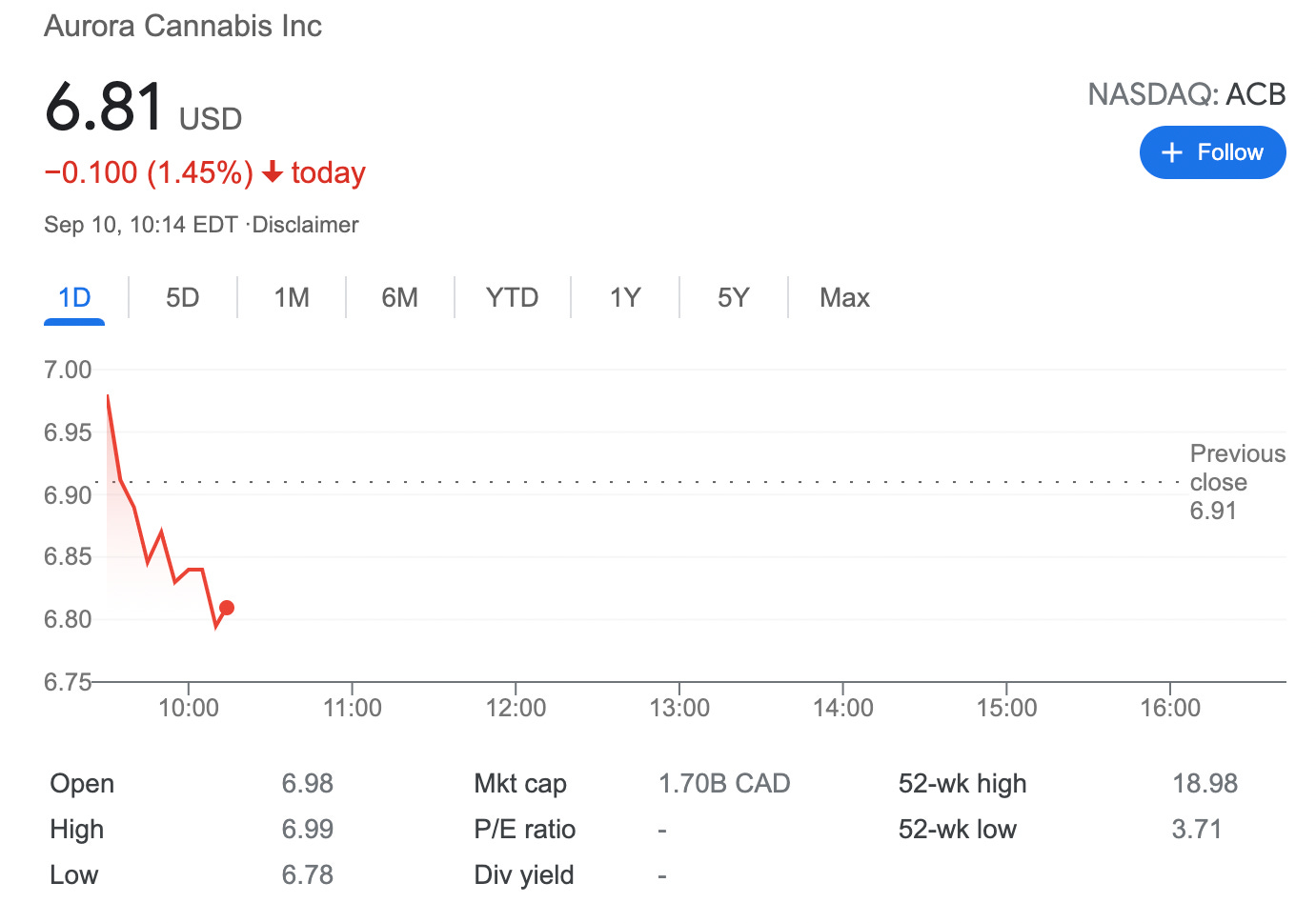

On September 10, 2021, I did a second partial roll forward and roll down on a credit spread I established back at the end of July on ACB stock

As the expiry date approached and ACB was in the money, and not wanting yet to turn this trade into a covered call, I decided to roll it out.

Here is the trade setup:

BOT 3 ACB SEP 10 '21 7 Put Option 0.17 USD

BOT 3 ACB OCT 29 '21 - 6.5 + 5.5 Put Bull Spread -0.33 USD

Here I bought back 3 contracts with the strike prices of $7, for them I paid in total $51 and sold 3 additional credit spreads with lower strike prices and with an expiry set at the end of October. For this trade, I got $99 (before commissions)

I lowered the strike prices from $7 to $6.5.

What happens next?

On the expiry date, October 29, 2021, ACB is trading above $6.5 per share - options expire worthlessly and I keep premium - if ACB trades under $6.5 on the expiry date, I will get assigned 300 shares

New break-even price $6.5-$0.55 = $5.95

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.