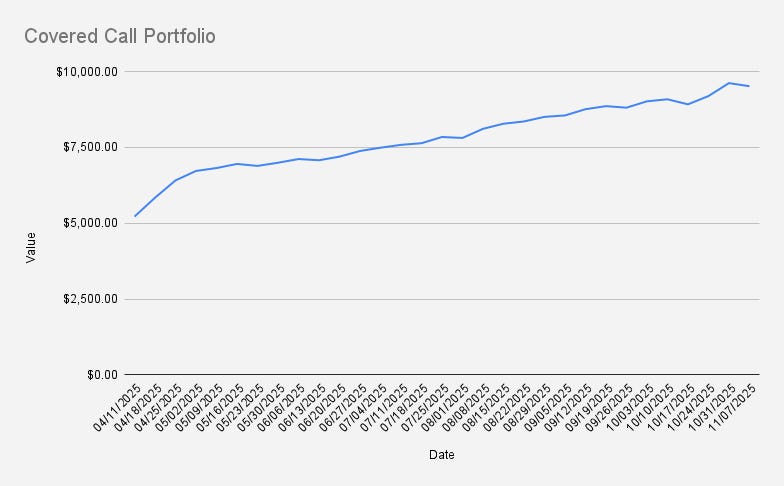

NVDA Dip Trims Covered-Call Portfolio to $9,514

As of November 7, 2025, our covered call stock portfolio has slightly dipped to to $9,514, what is a minor decrease of -1.07% (+$102 if compared to the previous week.

The dip is mainly due to the retracement in NVDA’s price and our need to adjust the bull put credit spread on it this Friday.

Most of the week was quite slow and uneventful — which is usual…