LI and KO roll forward and up (call diagonal spreads)

On April 22, 2021, two of our existing call options on LI auto and KO stock were challenged and we decided to roll up and forward for a credit.

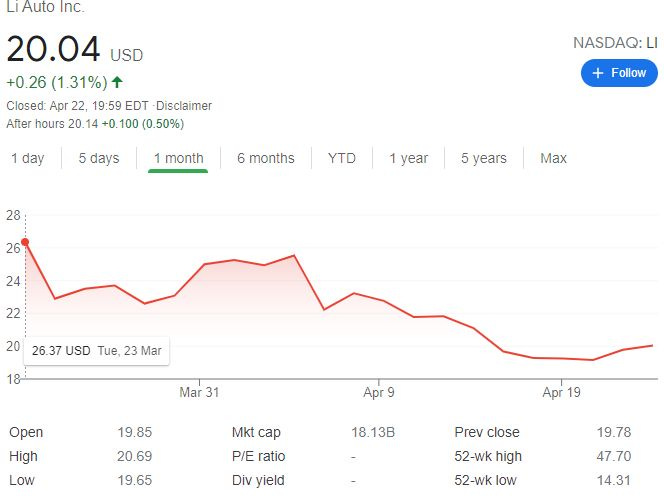

LI auto

Li Auto Inc., also known as Li Xiang, is a Chinese electric vehicle manufacturer headquartered in Beijing, with manufacturing facilities in Changzhou

We have been in this trade since March 02

We are struggling with this stock, and are rolling weekly (then up/then down)

As we have been buying LI using dollar-cost averaging our average buy price is: $27.56

here is our trade setup:

BOT 1 LI APR 23 '21 20.5 Call Option 0.28 USD

SLD 1 LI MAY 07 '21 22.5 Call Option 0.51 USD

Here we bought back the 20.5 call option paying $28 and sold a new call option with a higher strike at 22.5 and expiry further in the future and get paid $51

After commissions, we are keeping $18.

what can happen next:

LI is trading below our strike price of $22.5 at the expiry date (May 07, 2021), in such case, we keep the premium and sell more covered calls to lower our cost basis.

In case LI is trading above our strike price of $22.5, our 100 shares get called away at the strike price of $22.5 and we realize our max gain (loss), -$655 or -15.85% potential income in 67 days

In case our strike price will get challenged, I will roll up and forward for credit.

Break-even: $26.12

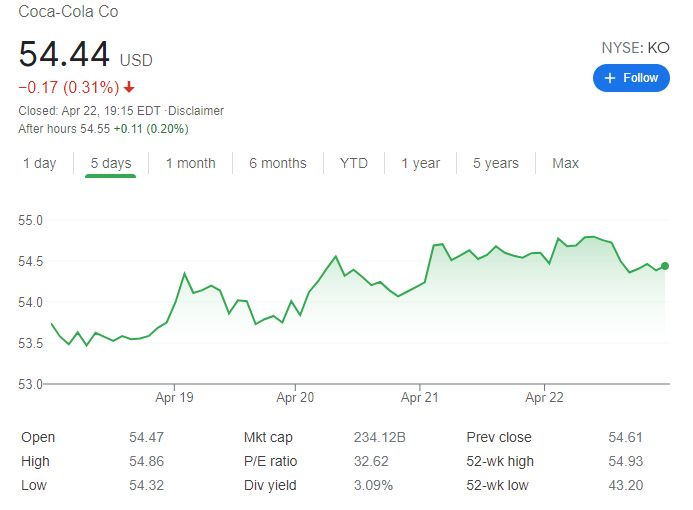

KO

As we have been buying KO using dollar-cost averaging our average buy price is: $50.44

With KO price hovering around $54.5, we decided to roll up our $54 call option, not to risk early assignment

here is our trade setup:

BOT 1 KO APR 30 '21 54 Call Option 0.76 USD

SLD 1 KO MAY 21 '21 54.5 Call Option 0.92 USD

we decided to buy back 54 strike call, and sol a new, higher 54.5 strike with expiry on May 21, 2021. The aftermath of this trade +$11.2

what can happen next:

KO is trading below our strike price of $54.5 at the expiry date (May 21, 2021), in such case, we keep the premium and sell more covered calls to lower our cost basis.

In case KO is trading above our strike price of $54.5, our 100 shares get called away at the strike price of $54.5 and we realize our max gain of $417.2 or 8.27% potential total income return in 60 days

Break-even: $50.18