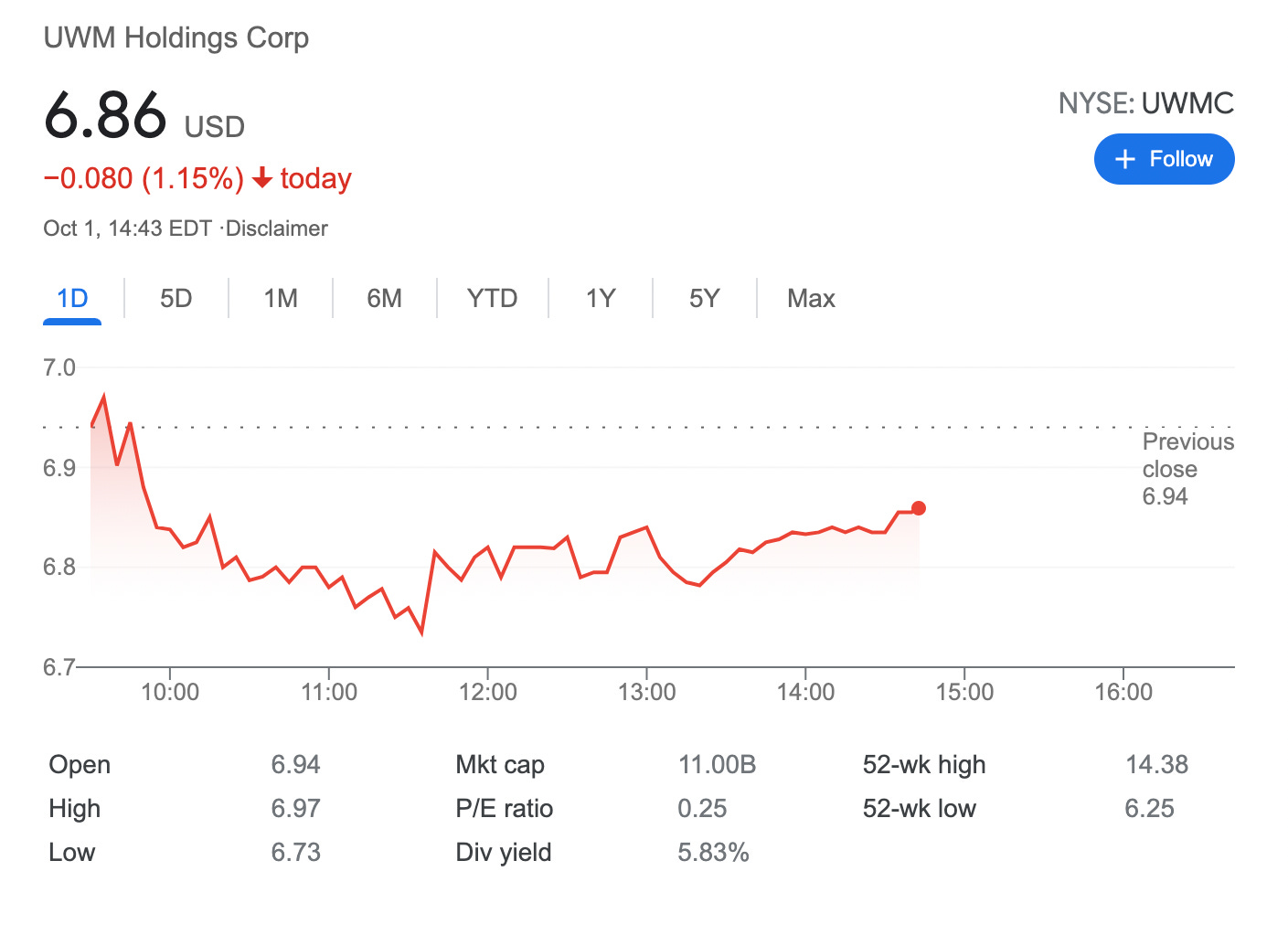

Established New Covered Call on UWMC; Potential Income return 3.9% in 7 days

On October 01, 2021, I bought 100 shares with UWMC stock paying $6.82 per share, and simultaneously sold 1 covered call on these shares with a strike price of $7 and expiry next Friday. Credit received $11 (before commissions)

United Wholesale Mortgage (NYSE: UWMC) is the wholesale mortgage lender

I discovered this stock by a chance when reading some articles about potential dividend stock investment. Turns out UWMC is both optionable and also pays a relatively high dividend of about 5% annually.

here is the trade setup:

BOT 100 UWMC Stock 6.818 USD

SLD 1 UWMC OCT 15 '21 7 Call Option 0.11 USD

here I bought 100 shares, in total paying $682 and sold a covered call for $11 (before commissions)

What happens next?

On the expiry date, October 08, 2021, UWMC is trading under $7 per share - options expire worthlessly and I keep premium - if UWMC trades above $7on the expiry date, my 100 shares will get called away and I realize my max profit $26.6 or potential 3.9% yield in 7 days.

Break-even price: $6.82-$0.08= $6.74

I prefer selling options on stable dividend stocks, in that manner collecting both dividend and option premium. Let’s hope - UWMC is stable enough.