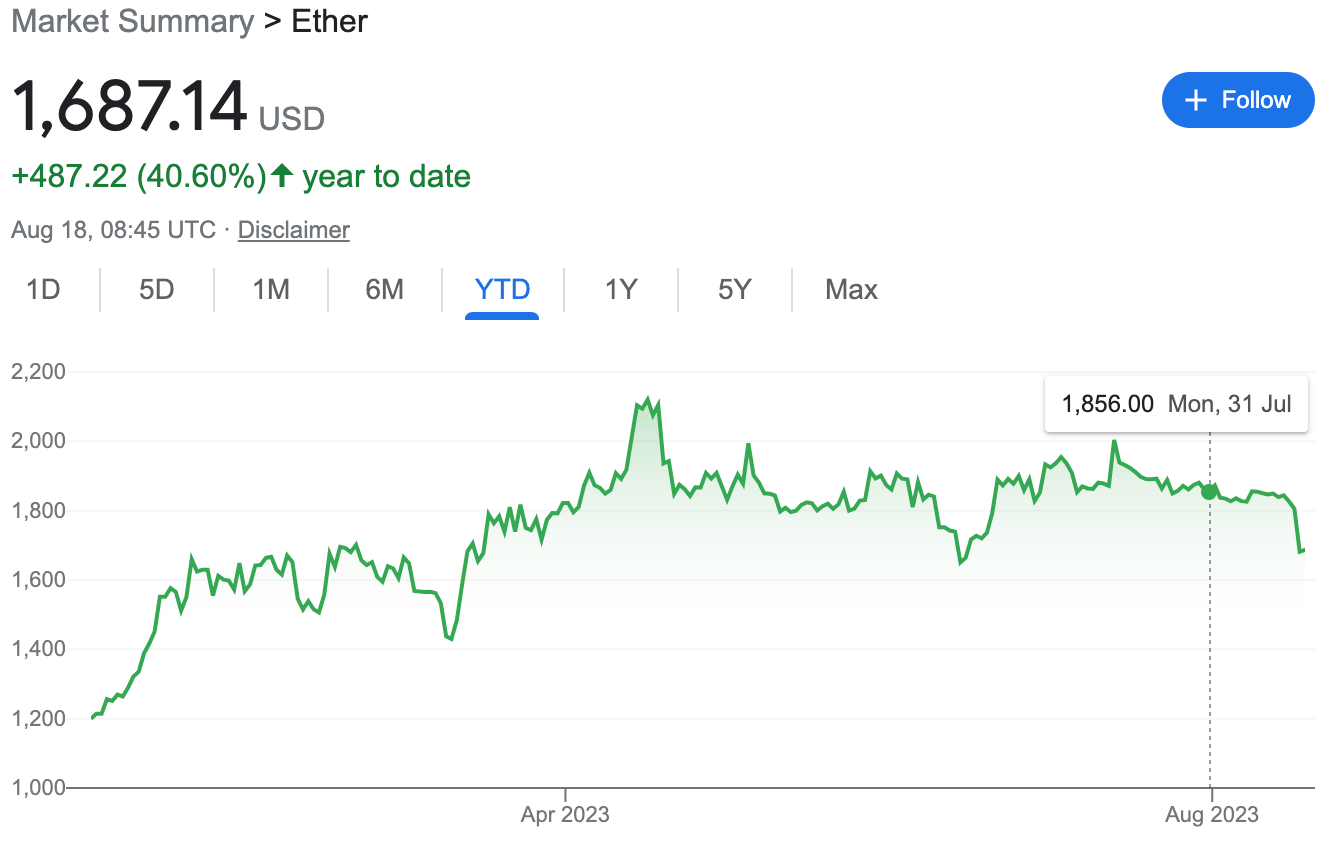

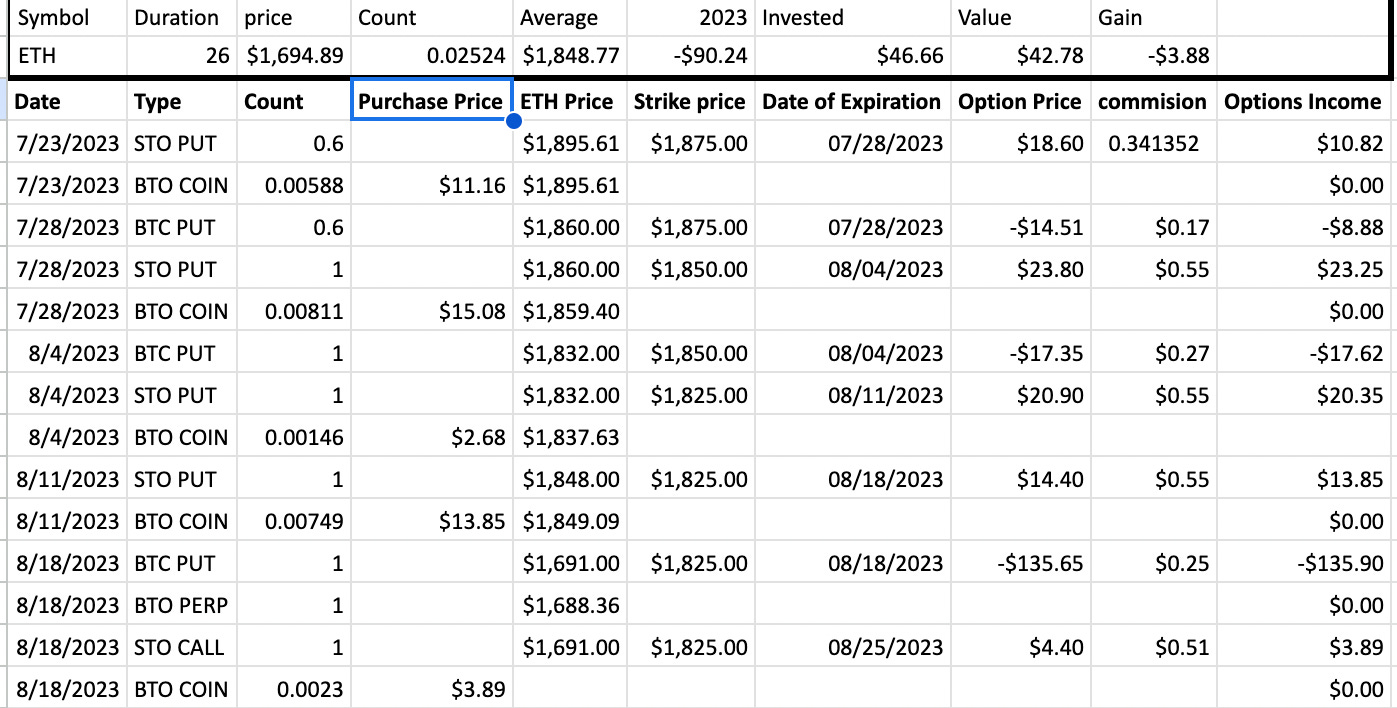

Established 1 Covered Call Ethereum - 2.54% potential income return in 33 days (28.09% annualized)

On August 18, 2023, I established 1 call option on Ethereum crypto coin, a position originally opened at the end of July 2023 as a put option.

I established this position after our previous put option at $1,825 expired in the money.

Usually, I prefer rolling forward for a credit, suffering position, but this time I was not able to find decent strike prices or premiums and decided to go the covered call way - by buying 1 ETH using perpetual futures at 1,688.36 and simultaneously selling 1 Call option with next week's expiry and a strike price of $1,825

From the premium received, I bought additional 0.00230 ETH itself.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset

here is the trade setup:

BOT 1 ETH 1,688.36

SLD 1 ETH AUG 25 '23 1825 CALL Option 4.4

The aftermath of this trade + $3.89 (after commissions)

What happens next?

On the expiry date, August 25, 2023, ETH is trading under $1,825 per coin - options expire worthlessly, I keep premium and start over by selling additional call options - if ETH trades above $1,825 on the expiry date, I risk 1 ETH getting called away, thus realizing my max gain.

As I already have collected a premium of $46.4 per coin, my break-even price for this trade is 1,825-46.4= $1,778.6

With the current ETH price at $1,689, we are losing about $100 in this trade so far.

In total: 14 trades since July 23, 2023

Options premium: -$90.24