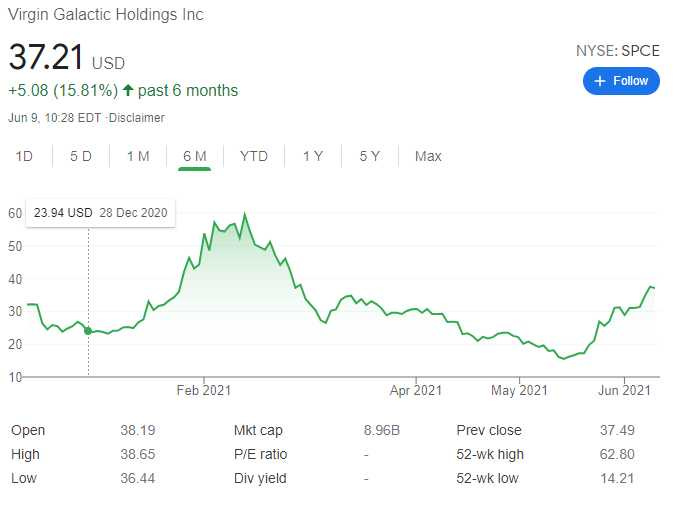

Buying LEAP Call Option with Virgin Galactic SPCE stock to protect from losses and profit in future

As I was mentioning in my YouTube video, today I bought a LEAP call option on SPCE stock to protect my account from future losses.

Let me explain - I’ve been buying SPCE stock for the past couple of months, currently holding 215 shares.

Average stock buys price $24.64.

Also, I have been selling covered call options and to spice it up I was selling some naked call options.

In total 5 call options contracts with different strike prices and different expires. .2 covered and 3 naked call options

With the recent steep price incline above $35 per share, those uncovered call options started to suffer a lot and affected the total portfolio.

I did a few roll-ups, managed to increase strike prices from $22 to $26, but still feeling worried about those 3 uncovered call positions, decided to buy a long expiry SPCE call option.

here is my trade setup:

BOT 1 SPCE JAN 20 '23 20 Call Option 23.30 USD

I paid $2,330 to buy January 20, 2023, SPCE call option with a strike price of $20. Alternatively, I could buy 100 shares with SPCE paying $3,700… so I’m saving some money here already, but I have to be careful and not let this contract expire.

Anyhow this contract is more than 2 years long and I can now control 100 shares with SPCE. I’m very confident I will get out of this trade quite earlier, but you never know.

What happens next?

I now have 3 covered call contracts out of 5.

If SPCE keeps increasing in price, my losses are stopped here for at least one contract. Two to go. If SPCE decreases in price, I will have a chance to take advantage and close the losing two calls.

Might sound complicated, I agree

by the way, here is the video, I talk about these things