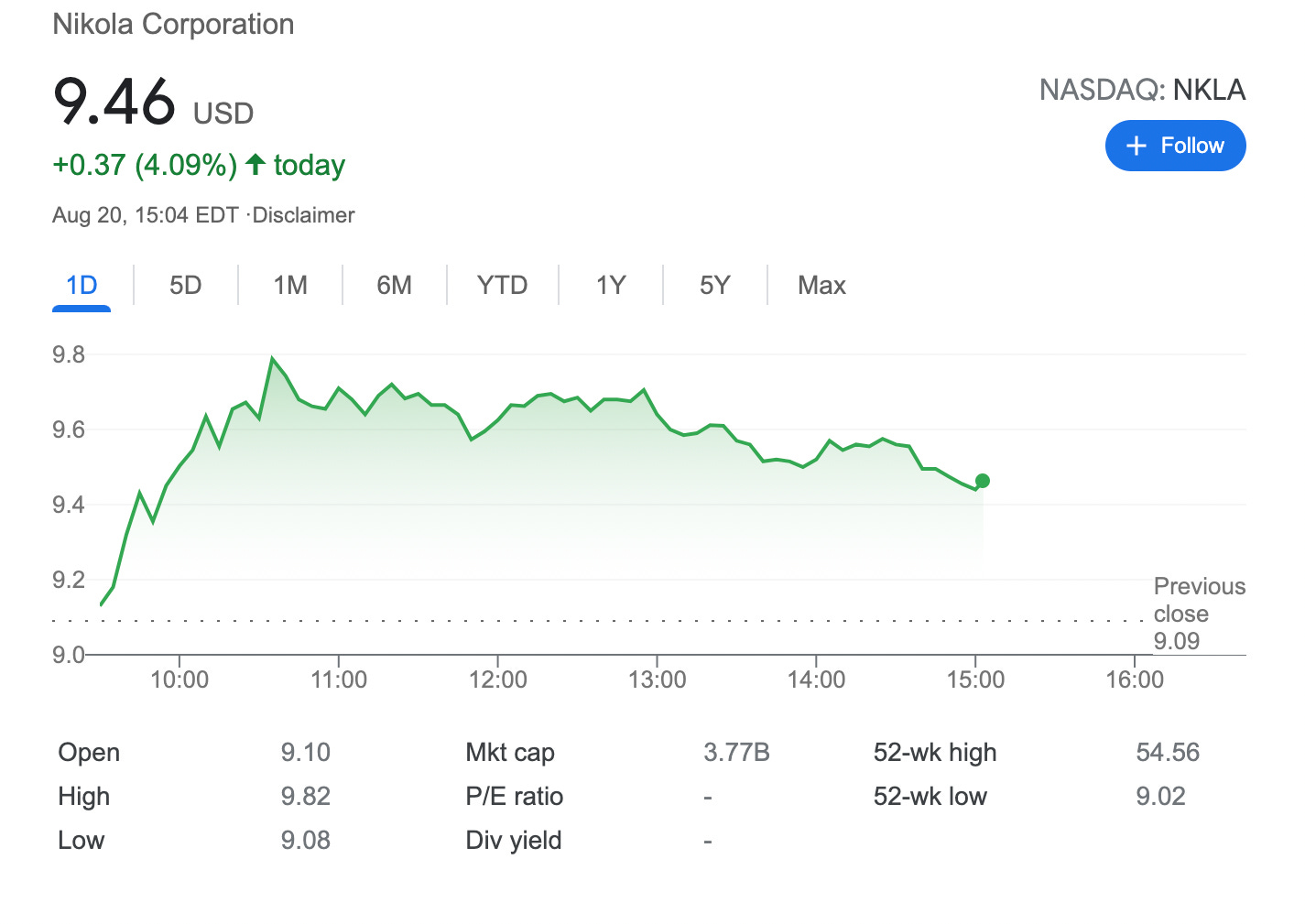

Another Partial Roll Forward and Down 3 Credit Spreads on NKLA –1.45% potential income return in 121 days

On August 20, 2021, I did another partial roll forward and roll down on a credit spreads I established at the end of July on NKLA stock.

While holding 3 credit spreads on NKLA stock with expiry today, and while the stock has been failing through the roof and touching my strike prices, I decided to spread the risk and not take a full assignment of 3 contracts or 300 shares, but instead take just 1 contracts and roll forward the rest.

So far I have rolled forward and down already 4 out of 5 original contracts

Here is the trade setup:

SLD 2 NKLA AUG 20 '21 - 13 + 11 Put Bull Spread -2.01 USD

BOT 3 NKLA NOV 19 '21 - 8 + 4 Put Bull Spread -0.95 USD

Here I bought back 2 contracts with the strike prices of $13 and $11, for which I paid $402, and sold 3 additional credit spreads with lower strike prices and with an expiry set in November. For this trade, I got $285 (before commissions)

What happens next?

On the expiry date, November 19, 2021, NKLA is trading above $8 per share - options expire worthlessly and I keep premium - if NKLA trades under $8 on the expiry date, I will get assigned 300 shares

As this trade actually is with a negative outcome, I have lost -12 cents per share, my break-even price for this trade then will be $8+$0.12 = $8.12

In case, these contracts will expire worthlessly I will realize a max loss of $35 in 121 days.

Otherwise, I will take the assignment and will start selling covered calls