Amazon Trade Adjustment: Turning Bear Call spread into Iron Condor

On March 16th, 2023, I sold 1 bull put spread on Amazon stock with strike prices at $90 and $85 with expiry on March 31, 2023). For this trade setup, I was rewarded with $31 (after commissions).

When setting up this trade I was looking for a high probability profit trade and chose my strike prices with Delta less than 0.1.

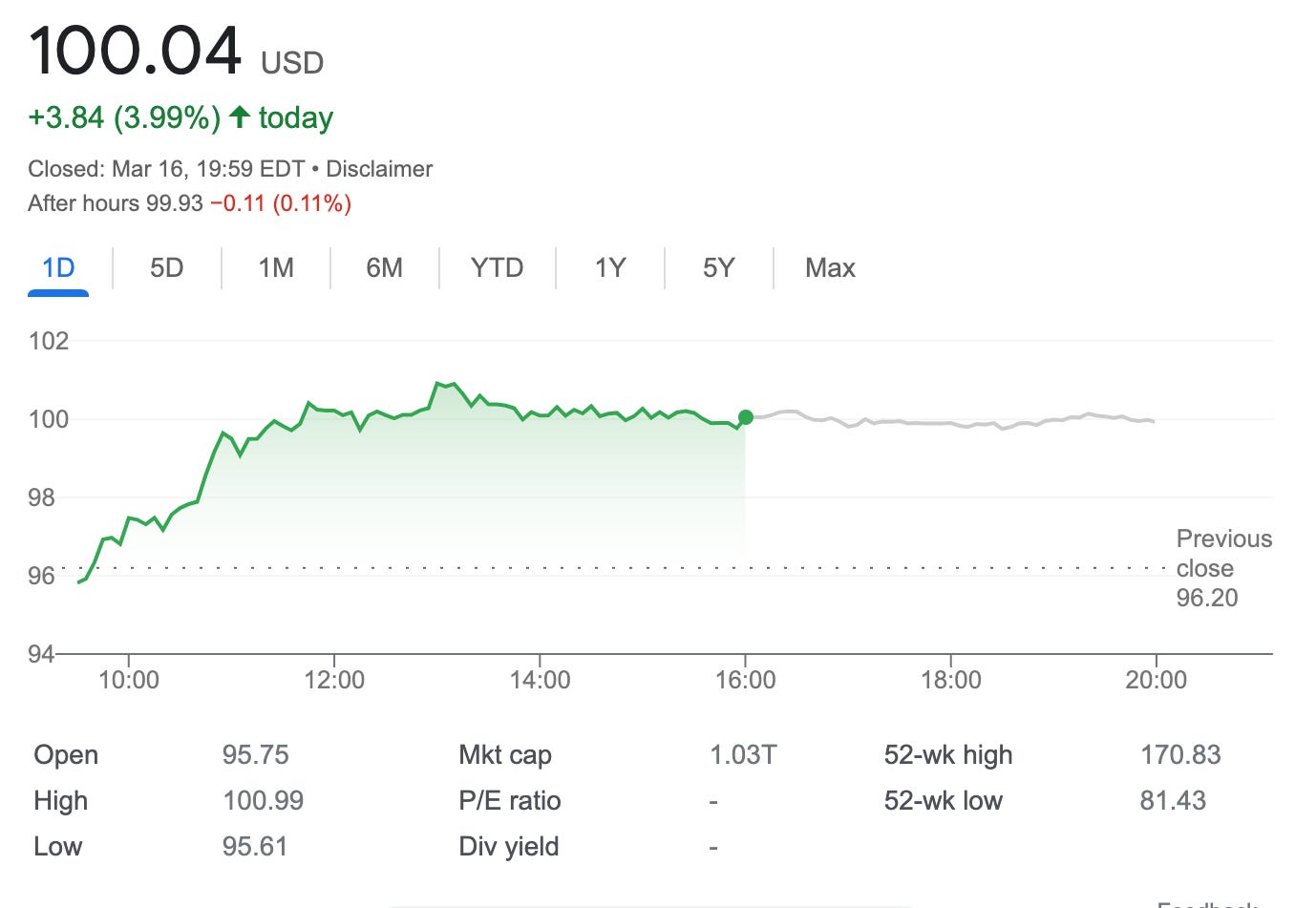

This trade actually comes as a hedge against the suffering bear call spread I opened on Amazon stock on March 7th.

With Amazon stock rising closer to my short call leg ($105) I was left with few options on how to adjust. - I could roll out, close with a small loss, or turn this trade into Iron condor, thus increasing the premium received and still leaving some option to roll out if under pressure.

Keep reading with a 7-day free trial

Subscribe to Covered Calls with Reinis Fischer to keep reading this post and get 7 days of free access to the full post archives.