3 Trades ideas to Generate $95/weekly Selling Put options

If there is an options strategy I like even more than selling covered calls, then it is - selling put options on stocks I wouldn’t mind keeping in my long-term stock portfolio.

I would advocate selling put options against stable dividend aristocrat stocks, but if you don’t mind adding some spice to your portfolio mix - weekly options might be the answer.

In today's article, I'm going to talk about selling put options on calls on NIO, Vale, and SPCE stocks. These are the stocks I actually trade options with, but as usual:

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

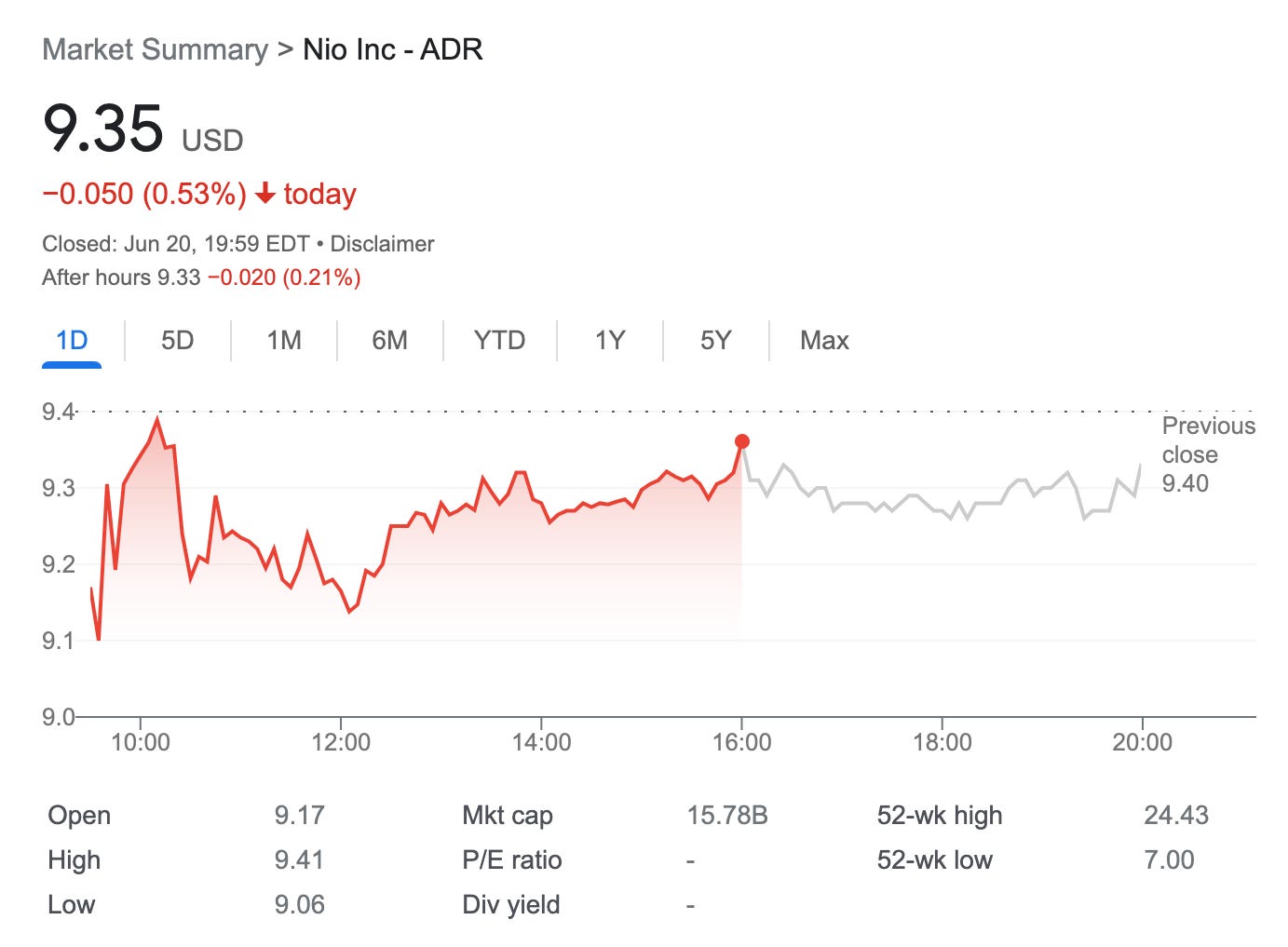

Generate weekly income selling put options on NIO (NYSE:NIO) stock

Nio Inc. is a Chinese multinational automobile manufacturer headquartered in Shanghai, specializing in designing and developing electric vehicles. The company develops battery-swapping stations for its vehicles, as an alternative to conventional charging stations

On June 21, 2023, you could sell a put option on NIO stock with a June 30 expiry and strike price of $9 for about $0.25. That gets you $25 and makes about 2.77% return in less than 10 days. Break-even: $8.75

If NIO stock closes above $9 on June 30 you keep the premium and can start over. If the stock closes under $9 you risk getting assigned 100 shares, but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take the assignment and turn it into a covered call.

Remember, you are selling one contract, 100 shares of NIO stock, make sure you have $900 cash or in buying power (margin) to buy 100 shares if assigned.

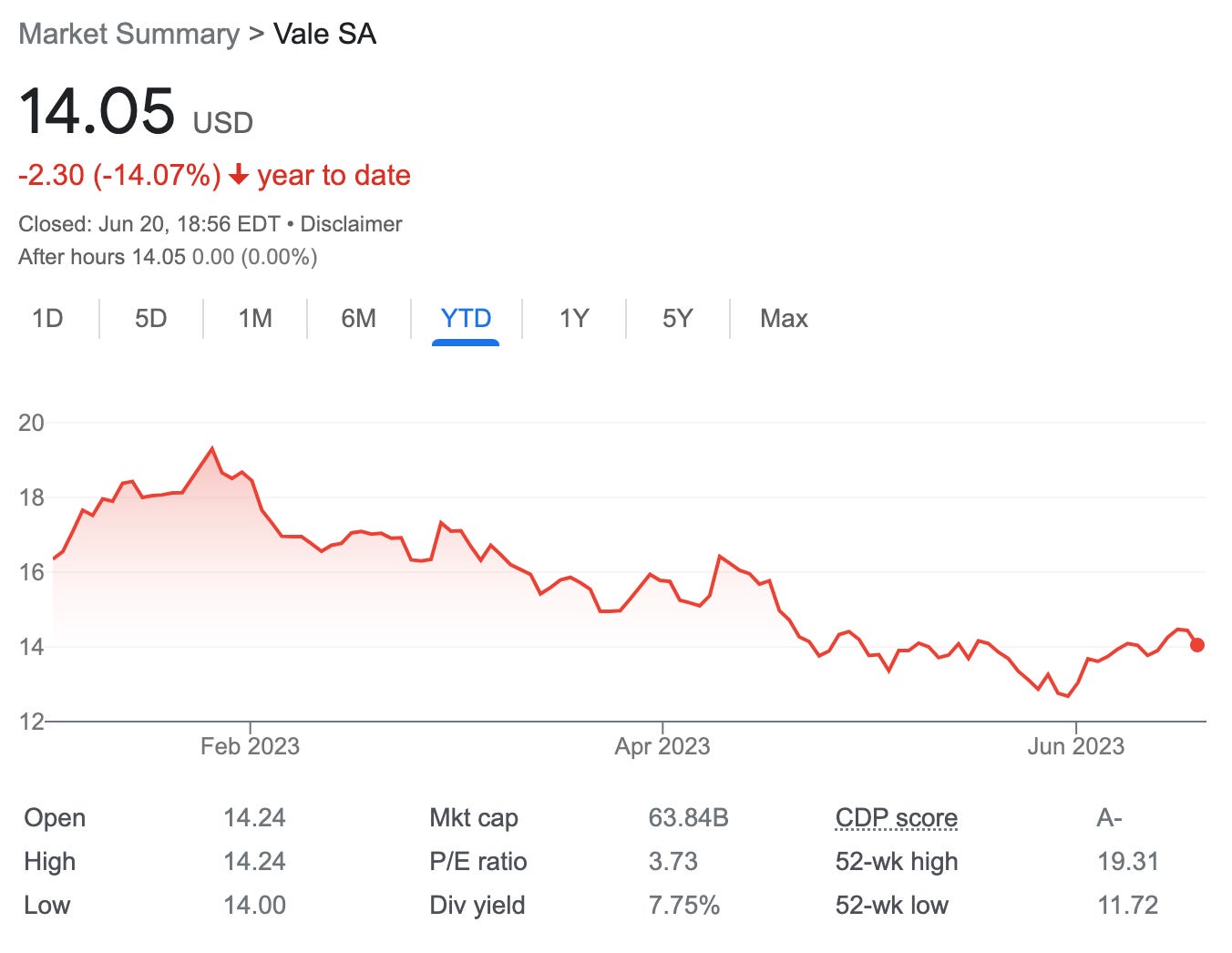

Generate weekly income selling put options on VALE SA (NYSE:VALE) stock

Vale S.A., formerly Companhia Vale do Rio Doce is a Brazilian multinational corporation engaged in metals and mining and one of the largest logistics operators in Brazil. Vale is the largest producer of iron ore and nickel in the world.

On June 21, 2023, you could sell a put option on VALE stock with a June 30 expiry and strike price of $14 for about $0.29. That gets you $29 and makes about 2.07% return in less than 10 days. Break-even: $13.71

If VALE stock closes above $14 on June 30 you keep the premium and can start over. If the stock closes under $14 you risk getting assigned 100 shares, but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take the assignment and turn it into a covered call.

Remember, you are selling one contract, 100 shares of VALE stock, make sure you have $1,400 cash or in buying power (margin) to buy 100 shares if assigned.

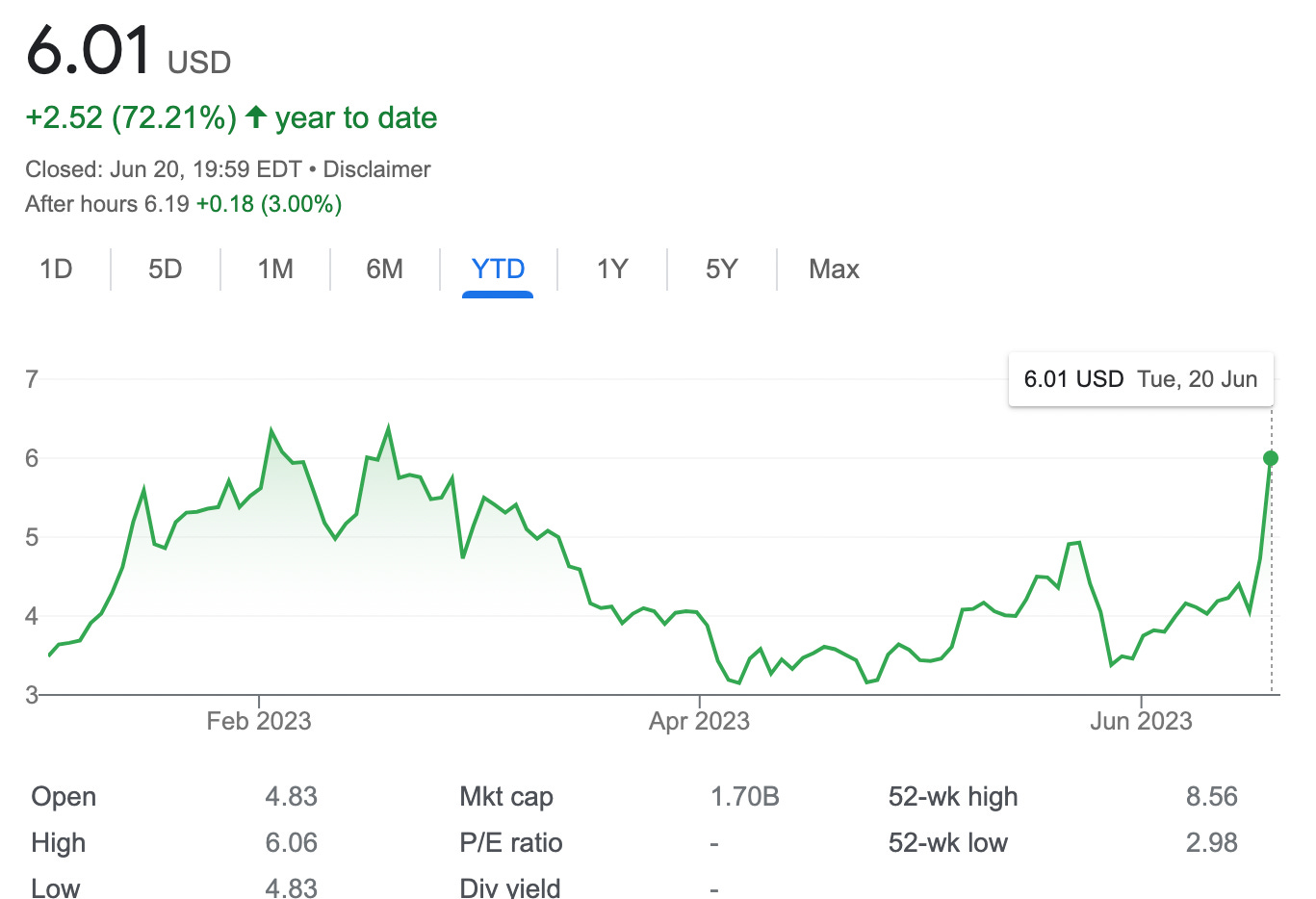

Generate weekly income selling put options on Virgin Galactic (NYSE:SPCe) stock

Virgin Galactic is a spaceflight company founded by Richard Branson and the Virgin Group conglomerate which retains an 11.9% stake through Virgin Investments Limited. It is headquartered in California, and operates from New Mexico.

On June 21, 2023, you could sell a put option on SPCE stock with a June 30 expiry and strike price of $5 for about $0.41. That gets you $41 and makes about 8% return in less than 10 days. Break-even: $4.59

If SPCE stock closes above $5 on June 30 you keep the premium and can start over. If the stock closes under $5 you risk getting assigned 100 shares, but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take the assignment and turn it into a covered call.

Remember, you are selling one contract, 100 shares of SPCE stock, make sure you have $500 cash or in buying power (margin) to buy 100 shares if assigned.

Selling put options on these three stocks will generate about $95 in income against $2,800 in possible stock purchases. About 3.39% return in less than 10 days.

In conclusion, selling put options on these three stocks can generate consistent income and help investors increase their returns. However, it's important to note that this strategy involves risk, and investors should carefully consider their risk tolerance and investment goals before implementing it.